Home for A Mother of Three

Donation protected

Hello Friends and Global Community! We have a special opportunity to help Black women own homes and create generational wealth for their families. I will tell you more about this opportunity, but first let me share some valuable information about African Americans and home ownership in America.

*********************************

Did you know that Homeownership is lower for Black college graduates than for white high school dropouts?

How can that be true? How can someone with a college degree NOT have a better chance at buying a house? A researcher with the Urban Institute explains, “African Americans with four-year college degrees have a lower homeownership rate than white Americans without a high school diploma,” citing data from the 2017 American Community Survey. (1)

Did you know that student loan debt is a big reason why Black home ownership decreases for Black Americans?

According to a 2018 issue brief by the Center for Responsible Lending on the ways student loan debt widen the racial wealth gap, “Student loan debt was mentioned as a potentially significant contributor to the growing gap between black and white homeownership. Of all racial groups, African Americans have more student loan debt, and African Americans with a college degree are five times more likely to default on their student debt than white Americans. These inequalities in the shouldering of the student debt burden may therefore also be contributing to the widening homeownership gap, as those who carry or default on student debt are less likely to meet mortgage lending credit standards.” (2)

The Wall Street Journal reports, “Black homeownership is in crisis. Although homeownership rates for other racial groups have largely recovered since the 2008 housing crisis, black homeownership continues to decline, recently hitting an all-time low in the first quarter of this year.” (3)

“Homeownership is beneficial for building household wealth, increasing intergenerational economic mobility, offering a hedge against inflation, and increasing civic engagement, all of which make the ongoing decline in black homeownership deeply troubling," according to the Urban Institute. (4)

At the Housing Finance Policy Center’s recent data talk on the black homeownership gap, experts presented important data on the state of black homeownership. These five facts effectively sum up the crisis. (5)

****************************

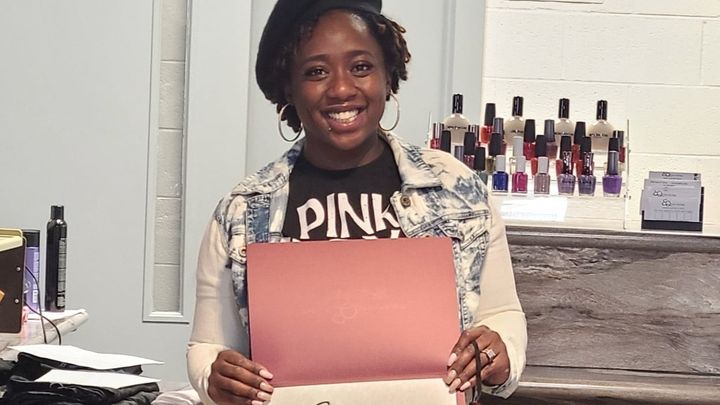

Jasmine is a mother of two children and one on the way in May 2021. She recently graduated from cosmetology school in late 2020 and as you can expect, she is inundated with not only the looming burden of student loan debt but also caring for two young children, a son who is 7 and a daughter who will soon be 8 months old. She is currently renting a two-bedroom house, working in her field as a stylist to make ends meet, and working on improving her credit score. Jasmine is doing her part, but often that is not enough for Black people seeking to be homeowners due to systemic and systematic racism, housing discrimination, redlining, and predatory lending practices rooted in white supremacy.

And because of these unjust practices, it’s important for those of us who believe in being anti-racist to support grassroots economic justice (reparations) initiatives to put money directly into the hands of descendants of enslaved Africans as a form of reparations to assist in creating generational wealth for their descendants. We have the opportunity to do this now and not wait on the government to pay the debt owed to Black Americans whose ancestors received nothing for their forced labor to help build America with their blood, sweat, and tears.

I am asking you to support this reparations fundraiser by contributing frequently and sharing consistently with your networks, specifically other white people. Jasmine will need at least a 3-bedroom house and the money gathered through this fundraiser will help her to do that hopefully debt-free to avoid the additional stress of needing to pay a house payment. We can do this. We must do this as one way to right the wrongs of chattel slavery. Let’s do it.

The funds will go directly to Jasmine’s account so she can have complete sovereignty over her choice for a home.

If possible, please add an additional 3% to your contribution to offset the fees of hosting this fundraiser on this platform.

Thanks in advance for your contribution.

#HomeForMotherOfThree #EconomicJustice #Reparations

Sources:

1. https://www.responsiblelending.org/sites/default/files/nodes/files/research-publication/crl-student-loan-wealth-gap-dec2018.pdf

2. https://www.wsj.com/articles/black-homeownership-drops-to-all-time-low-11563183015

3. https://www.urban.org/urban-wire/what-explains-homeownership-gap-between-black-and-white-young-adults

4. https://www.urban.org/events/black-homeownership-gap-research-trends-and-why-growing-gap-matters

5. https://www.urban.org/urban-wire/these-five-facts-reveal-current-crisis-black-homeownership

*********************************

Did you know that Homeownership is lower for Black college graduates than for white high school dropouts?

How can that be true? How can someone with a college degree NOT have a better chance at buying a house? A researcher with the Urban Institute explains, “African Americans with four-year college degrees have a lower homeownership rate than white Americans without a high school diploma,” citing data from the 2017 American Community Survey. (1)

Did you know that student loan debt is a big reason why Black home ownership decreases for Black Americans?

According to a 2018 issue brief by the Center for Responsible Lending on the ways student loan debt widen the racial wealth gap, “Student loan debt was mentioned as a potentially significant contributor to the growing gap between black and white homeownership. Of all racial groups, African Americans have more student loan debt, and African Americans with a college degree are five times more likely to default on their student debt than white Americans. These inequalities in the shouldering of the student debt burden may therefore also be contributing to the widening homeownership gap, as those who carry or default on student debt are less likely to meet mortgage lending credit standards.” (2)

The Wall Street Journal reports, “Black homeownership is in crisis. Although homeownership rates for other racial groups have largely recovered since the 2008 housing crisis, black homeownership continues to decline, recently hitting an all-time low in the first quarter of this year.” (3)

“Homeownership is beneficial for building household wealth, increasing intergenerational economic mobility, offering a hedge against inflation, and increasing civic engagement, all of which make the ongoing decline in black homeownership deeply troubling," according to the Urban Institute. (4)

At the Housing Finance Policy Center’s recent data talk on the black homeownership gap, experts presented important data on the state of black homeownership. These five facts effectively sum up the crisis. (5)

****************************

Jasmine is a mother of two children and one on the way in May 2021. She recently graduated from cosmetology school in late 2020 and as you can expect, she is inundated with not only the looming burden of student loan debt but also caring for two young children, a son who is 7 and a daughter who will soon be 8 months old. She is currently renting a two-bedroom house, working in her field as a stylist to make ends meet, and working on improving her credit score. Jasmine is doing her part, but often that is not enough for Black people seeking to be homeowners due to systemic and systematic racism, housing discrimination, redlining, and predatory lending practices rooted in white supremacy.

And because of these unjust practices, it’s important for those of us who believe in being anti-racist to support grassroots economic justice (reparations) initiatives to put money directly into the hands of descendants of enslaved Africans as a form of reparations to assist in creating generational wealth for their descendants. We have the opportunity to do this now and not wait on the government to pay the debt owed to Black Americans whose ancestors received nothing for their forced labor to help build America with their blood, sweat, and tears.

I am asking you to support this reparations fundraiser by contributing frequently and sharing consistently with your networks, specifically other white people. Jasmine will need at least a 3-bedroom house and the money gathered through this fundraiser will help her to do that hopefully debt-free to avoid the additional stress of needing to pay a house payment. We can do this. We must do this as one way to right the wrongs of chattel slavery. Let’s do it.

The funds will go directly to Jasmine’s account so she can have complete sovereignty over her choice for a home.

If possible, please add an additional 3% to your contribution to offset the fees of hosting this fundraiser on this platform.

Thanks in advance for your contribution.

#HomeForMotherOfThree #EconomicJustice #Reparations

Sources:

1. https://www.responsiblelending.org/sites/default/files/nodes/files/research-publication/crl-student-loan-wealth-gap-dec2018.pdf

2. https://www.wsj.com/articles/black-homeownership-drops-to-all-time-low-11563183015

3. https://www.urban.org/urban-wire/what-explains-homeownership-gap-between-black-and-white-young-adults

4. https://www.urban.org/events/black-homeownership-gap-research-trends-and-why-growing-gap-matters

5. https://www.urban.org/urban-wire/these-five-facts-reveal-current-crisis-black-homeownership

Co-organizers (4)

Katie Howard

Organizer

Seattle, WA

Jasmine J Dennis

Beneficiary

Jennifer Wertkin

Co-organizer

Katherine Comford

Co-organizer

Sara Vargo Matuzak

Co-organizer