Save me from the USA IRS

TLDR: I have lived in the Netherlands nearly all my life and I'm being forced to file US taxes (on top of Dutch) under threat of having my bank account closed and massive fines, just because I was born there.

I need to become tax compliant and I wish to renounce my US citizenship.

Not long ago I found out about the Foreign Account Tax Compliant Act (FATCA) introduced by the American Internal Revenue Service (IRS) in 2010 and in effect since 2014. Simply put, this law was introduced to prevent tax evasion by US businesses and citizens.

However, it also indirectly forces Americans living abroad to file their taxes annually in the United States.

I was 6 years old when my parents (American mother, Dutch father) moved to the Netherlands, bringing me and my two older siblings. This was 28 years ago. I was raised here, educated here and have only ever made money and paid tax here. I consider myself Dutch, even though I speak English well and just happen to have an American passport.

It wasn't until about two years ago that my bank sent me a letter requesting my information as a US citizen. I called them to ask what it was about and they said that all US citizens are required to provide information regarding their status in regards to tax compliance with the IRS. I brushed it off, told the person on the phone that I've been living in the Netherlands for 28 years, since I was a small child, and left it at that. They bank didn't bother me again, but later I found out that if I was found to be in violation of FATCA, they would freeze my bank account. I began to worry, but figured the Dutch government would never let something like that happen.

Turns out they would and will.

Now, because I was born in the US, my bank account - the only one I've ever had - is considered a Foreign Account by the United States IRS. I am being forced to become tax compliant as a US citizen under threat of having my bank account frozen. The IRS has put together an 'amnesty program', allowing people like me to become tax compliant with a streamlined procedure. This is nice, even though the poorly veiled reference to criminal tax evasion isn't lost on me.

Simply becoming compliant, however, would not be the end of the story. I would have to file US taxes in perpetuity, with their confusing, convoluted system, which seems to change every year. As my Dutch taxes would be deductible, I most likely wouldn't have to pay anything, but I would be required to pay any differences in special situations leading to me having to pay double (Dutch + American) taxes for example buying a house, starting a business, or even getting married!

To bring an end to this story, I have decided I want to renounce my American citizenship. I consider myself Dutch, I've lived here all my life and I've only ever worked here. Every penny I've ever spent in the US, visiting family but like a tourist, I earned working in the Netherlands. I'm sad that a well-intentioned policy has such far reaching consequences for accidental Americans like me.

The costs involved are twofold: the first amount is to enlist the services of a tax preparing company and the second is to apply for a waiver of citizenship at the US embassy in the Netherlands, which I can do once I'm tax compliant. I did my very best to find the best deal I could find for the tax preparing service and the embassy fee is fixed.

$2295.00

$2350.00

TOTAL - $4645.00 (€4268,26)

This is a huge amount of money. I wish I could take care of becoming tax compliant on my own, but it's wildly complicated and I'm afraid of making mistakes, especially because of the threat of repercussions mentioned earlier and the fact that my application for a waiver of citizenship can be denied if my taxes aren't done properly.

For the past couple years I've been working mostly as a freelancer and I've recently lost all my work to COVID-19 related financial issues incurred by employers. I don't know how long it will take for me to find work again, so it would mean the world to me if you could support me with any amount. I'm not at immediate financial threat, but this amount of money is still going to hit me hard. I plan to donate all funds in excess of my target to WIRES Landcare Wildlife Relief Australia, an organization dedicated to implementing immediate response, recovery and resilience building projects for wildlife in bushfire and drought impacted communities across Australia.

See below links to the tax preparation service I will be employing, Americans Overseas, where you can find more information on FATCA and it's impact on accidental Americans, and WIRES:

Expat Tax Online

Americans Overseas

WIRES

If you have any questions for me, please contact me and I'll do my best to provide answers.

I need to become tax compliant and I wish to renounce my US citizenship.

Not long ago I found out about the Foreign Account Tax Compliant Act (FATCA) introduced by the American Internal Revenue Service (IRS) in 2010 and in effect since 2014. Simply put, this law was introduced to prevent tax evasion by US businesses and citizens.

However, it also indirectly forces Americans living abroad to file their taxes annually in the United States.

I was 6 years old when my parents (American mother, Dutch father) moved to the Netherlands, bringing me and my two older siblings. This was 28 years ago. I was raised here, educated here and have only ever made money and paid tax here. I consider myself Dutch, even though I speak English well and just happen to have an American passport.

It wasn't until about two years ago that my bank sent me a letter requesting my information as a US citizen. I called them to ask what it was about and they said that all US citizens are required to provide information regarding their status in regards to tax compliance with the IRS. I brushed it off, told the person on the phone that I've been living in the Netherlands for 28 years, since I was a small child, and left it at that. They bank didn't bother me again, but later I found out that if I was found to be in violation of FATCA, they would freeze my bank account. I began to worry, but figured the Dutch government would never let something like that happen.

Turns out they would and will.

Now, because I was born in the US, my bank account - the only one I've ever had - is considered a Foreign Account by the United States IRS. I am being forced to become tax compliant as a US citizen under threat of having my bank account frozen. The IRS has put together an 'amnesty program', allowing people like me to become tax compliant with a streamlined procedure. This is nice, even though the poorly veiled reference to criminal tax evasion isn't lost on me.

Simply becoming compliant, however, would not be the end of the story. I would have to file US taxes in perpetuity, with their confusing, convoluted system, which seems to change every year. As my Dutch taxes would be deductible, I most likely wouldn't have to pay anything, but I would be required to pay any differences in special situations leading to me having to pay double (Dutch + American) taxes for example buying a house, starting a business, or even getting married!

To bring an end to this story, I have decided I want to renounce my American citizenship. I consider myself Dutch, I've lived here all my life and I've only ever worked here. Every penny I've ever spent in the US, visiting family but like a tourist, I earned working in the Netherlands. I'm sad that a well-intentioned policy has such far reaching consequences for accidental Americans like me.

The costs involved are twofold: the first amount is to enlist the services of a tax preparing company and the second is to apply for a waiver of citizenship at the US embassy in the Netherlands, which I can do once I'm tax compliant. I did my very best to find the best deal I could find for the tax preparing service and the embassy fee is fixed.

$2295.00

$2350.00

TOTAL - $4645.00 (€4268,26)

This is a huge amount of money. I wish I could take care of becoming tax compliant on my own, but it's wildly complicated and I'm afraid of making mistakes, especially because of the threat of repercussions mentioned earlier and the fact that my application for a waiver of citizenship can be denied if my taxes aren't done properly.

For the past couple years I've been working mostly as a freelancer and I've recently lost all my work to COVID-19 related financial issues incurred by employers. I don't know how long it will take for me to find work again, so it would mean the world to me if you could support me with any amount. I'm not at immediate financial threat, but this amount of money is still going to hit me hard. I plan to donate all funds in excess of my target to WIRES Landcare Wildlife Relief Australia, an organization dedicated to implementing immediate response, recovery and resilience building projects for wildlife in bushfire and drought impacted communities across Australia.

See below links to the tax preparation service I will be employing, Americans Overseas, where you can find more information on FATCA and it's impact on accidental Americans, and WIRES:

Expat Tax Online

Americans Overseas

WIRES

If you have any questions for me, please contact me and I'll do my best to provide answers.

Organisateur

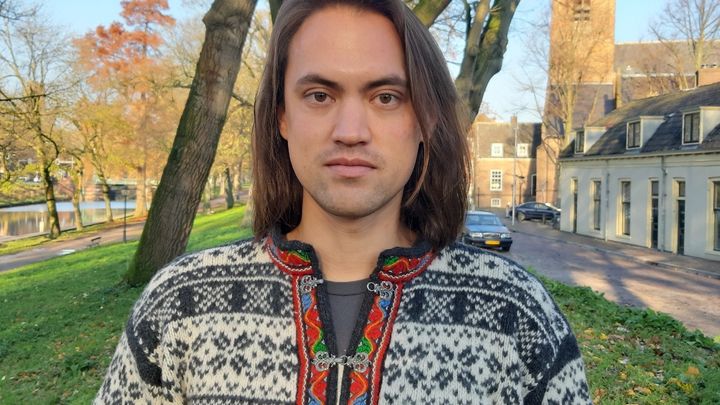

Sean Vink

Organisateur