- K

- D

I'm Alex, you might know me from a variety of art collaborations, running an art commissions forum with the goal of fairer conditions for artists, advocacy work, and generally struggling over the past few years. I've done a lot to contribute to the community, but I've needed help for a long time and it hasn't been easy to talk about.

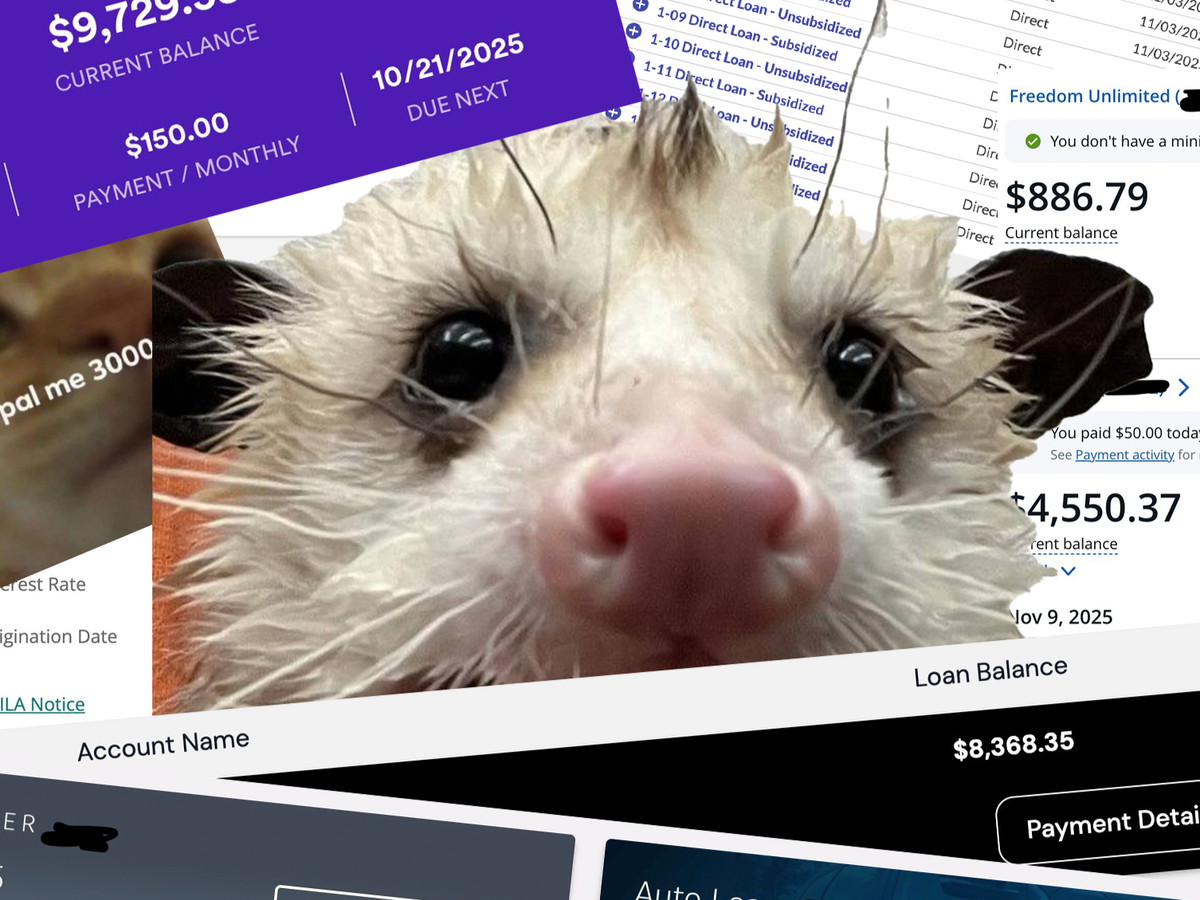

I have been fighting for stability for years after post-graduation hiccups sent my life into a spiral, and a good portion of that is due to being unable to afford monthly expenses without slipping behind on my budget despite my best efforts to save, and my Bachelor's degree currently like a millstone around my neck, having earned me less than if I had just skipped school to focus on my career despite assurances from my mentors. This sheer volume of debt combined with my unstable low income has continued to balloon without a meaningful way to stop it as efforts to earn more money have fallen flat between the job market and being rejected for plasma donation. I want to emphasize that I have not been trying to make unwise financial decisions.

Right now, the cash going out is so bad that I am not sure how I will afford healthcare this year as my rates have quadrupled, and I am unsure how I will save for the lean times of year.

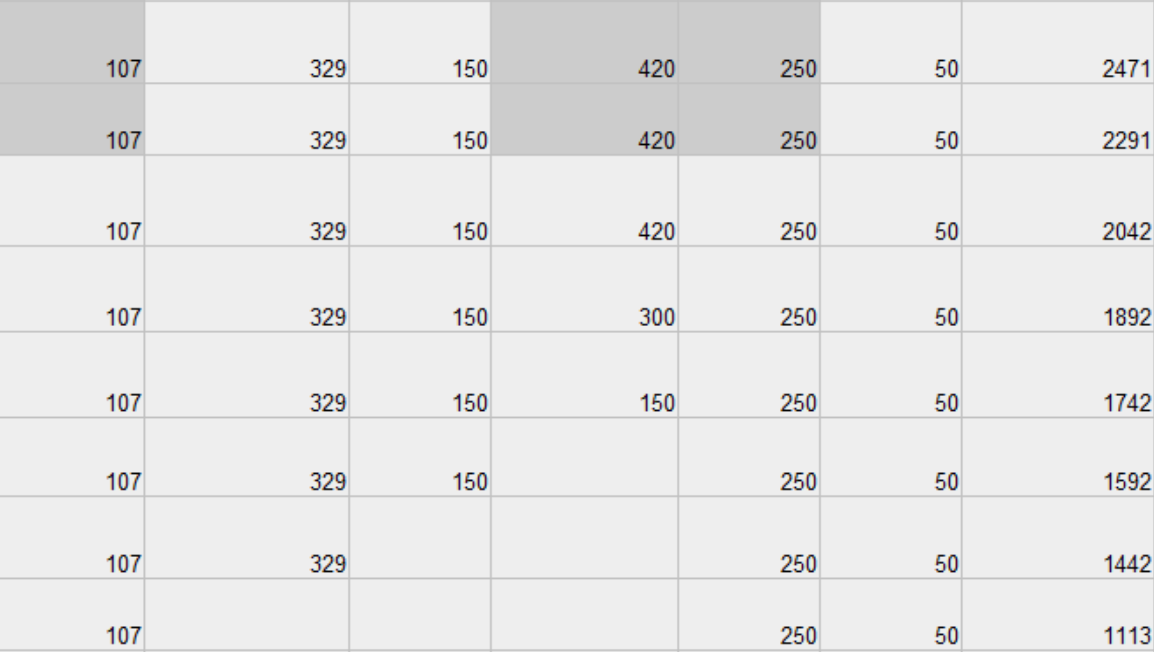

Starting from the easiest to open cashflow and highest-interest debts, I hope to pay down all of my consumer-side debt, seeing if I can negotiate for lower rates as my debt to income ratio shrinks. Tackling even a few of these items will reduce my monthly outflow to sustainable amounts, as my current interest alone is over a third of my monthly budget. As my monthly expenses lower, I should be able to dedicate more efforts to the remaining expenses and building long-term stability in a safer area.

I have considered bankruptcy, but with my current financial situation, that is not an option that would not create even more problems. I have done my best to reduce expenses as well, but further cuts are not viable and social services are no longer an option. This debt has actively prevented me from achieving any meaningful independence.

I hope that reducing my debt will set me back on the right track where I won't need more help.

At the time of writing, I have debts to tackle in the following priority.

- Credit Card 1 - $6300 at 25%(min payment $200)

- Credit Card 2 - $4100 (25%, min payment $150)

- Credit Card 3 - $670 (30%, min payment $25)

- Credit Card 4 - $1100 (25%, min payment $35)

- Credit Refinance 2 $17500 at $410 a month (cashflow and 14.5% interest)

These are the impacts that eliminating individual line items off of my budget will make towards livability, as my current obligations are more than my income.

I genuinely don't expect to make it this far, but I am also severely underwater on these expenses as stretch goals.

Car - $16300 on a car worth a lot less between repair costs and high interest.

Private Student Loan - $9400

Public Student Loan - $60000

Total debt: $110,000

I don't expect to have this all covered by other people. Any help is appreciated, and will contribute towards making it easier to dig myself out of this hole.