My mother co-signed a $45k loan

Three years ago, my (then) 73- year old mother co-signed a $45,000 student loan at the Bank of Montreal for "Barry", someone she considered a close friend. Last year, after making a few attempts at monthly payments, "Barry" defaulted on the loan. Collectors for the Bank of Montreal are now aggressively pursuing my mother for payment in full. We've tried everything to get "Barry" to pay, but it has become clear that he will not.

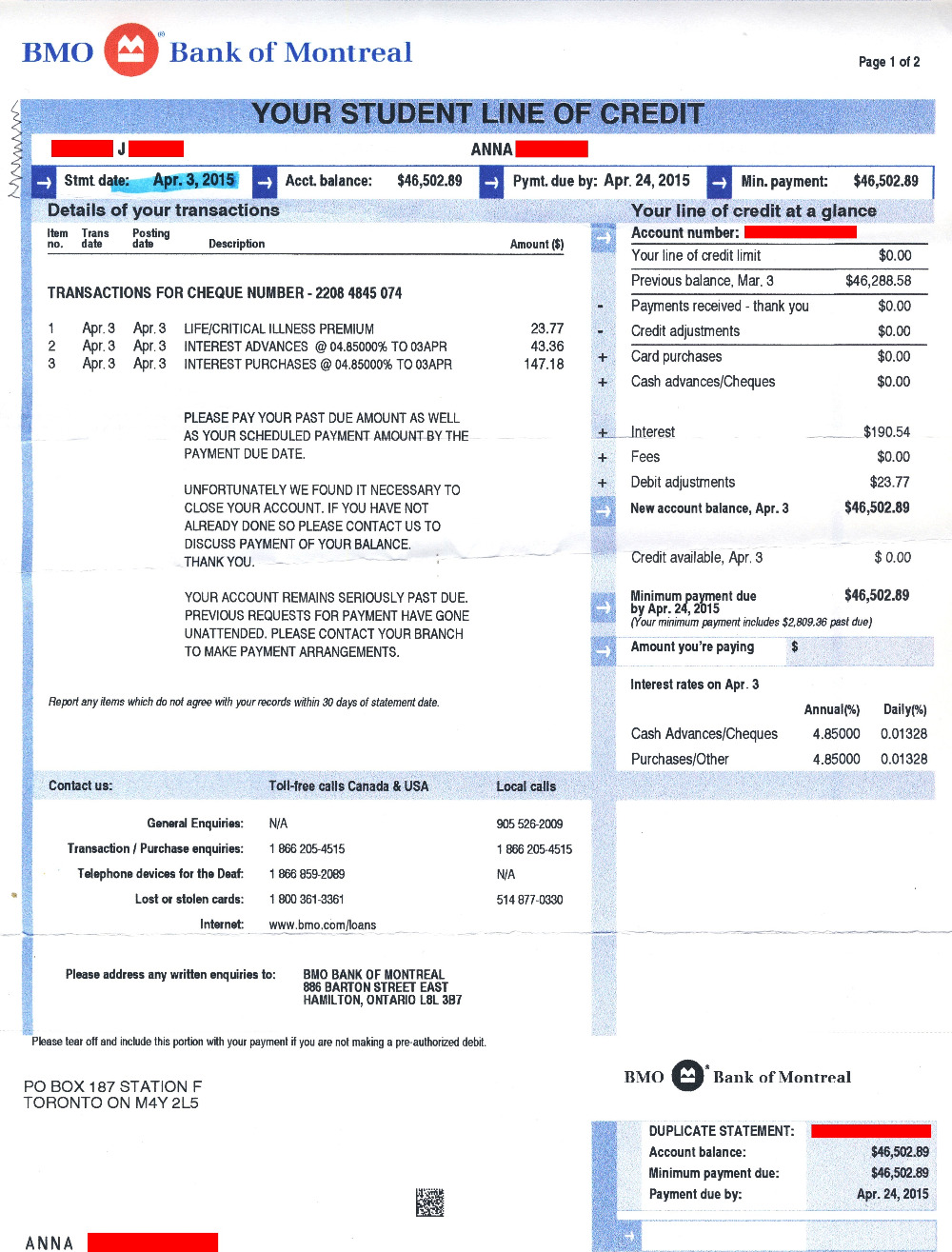

Mom is anxious and afraid. She fields threatening phone-calls and letters from BMO's collection agents almost daily. Interest and other fees and penalties are accumulating quickly on the loan. She is on a small fixed income and (at 76 years old) she works two part-time jobs in order to stay afloat. Mom will have to re-mortgage or sell her home in order to pay BMO - her chances of qualifying for a mortgage are dwindling, as this situation chips away at her credit rating.

Although it is infuriating that "Barry" will be off the hook if mom is able to pay off his loan, her peace of mind will be entirely worth it.

About Mom

Mom is a wonderful person. Kind, generous and community minded. Through the cold winter months she volunteers at the local "Out of the Cold " program, providing meals to hungry people in our community. She is an energetic member of the Grandmothers of Steel, and she crochets absolutely acres of winter hats every year for the homeless. Having grown up in Germany during the Second World War, she is a constant and vocal activist for peace. Mom is a lifelong advocate for education - both as a teacher and as a student. She opens her home every Friday night - friends and family always know they are welcome to join her for dinner. She and her spare bedroom have welcomed many people in tough spots over the years.

Now Mom is upset, and scared. Owning her own home, and being completely self-reliant - these things have always been deeply important to her. Much more so as she gets older. Through an innocent act of generosity and trust, she is now in a grim situation. Please help?

The full story is below...

Four years ago, my mother rented a room in her home to a 43 year old man. "Barry" had become a friend through her temple, and she liked and trusted him. He had inherited a sum of money from his father, along with two properties (which he sold) and he began taking courses at Ryerson toward a degree in finance. He was otherwise unemployed at that point.

"Barry" decided to take part in a study-overseas program for a year. This used up the remainder of his inheritance. Once it was gone, he applied for a student loan of $45,000, and asked mom to co-sign for him. She agreed (without telling me, or anyone). Her equity in her home acted as the collateral - mom is otherwise on a fixed income.

"Barry" returned from a year in France - full of stories, and nearly penniless. He moved back into mom's house, but he did not pay any rent. And there he stayed. Mom finally (nervously) asked him to leave in May 2013. She needed to rent out his room to someone who could pay. His pile of storage boxes remained behind in mom's garage for a few months, and "Barry" expressed a great deal of anger via email, but in the end he did move out.

In October 2013 "Barry's" bank notifed mom that the $45,000 loan (plus interest) was now in arrears, and that she was responsible for paying it back, in full. This was when I first learned about it. During that month, both Revenue Canada and other bill collectors also began phoning mom's house looking for "Barry".

"Barry" said something about getting on top of it, but the bank came back to mom again in February 2014 - more emphatically this time. I met with "Barry's" loan officer at BMO on mom's behalf, and then with a financial advisor. It appeared she would have to re-mortgage her home to pay off the balance - at least this way, the high interest rates and penalties would stop accumulating, and she could pay off the balance at the lower mortgage rate.

But "Barry" then responded to a facebook message (we no longer had a phone number or functional email address for him) and paid.

Things were quiet for a few months. The bank seemed satisfied. According to Facebook, "Barry" started taking classes toward an accounting designation. It appeared that he was taking care of things.

Then in November 2014 the bank notified mom that she had 10 days to pay off the full amount owed (then $46, 045. 52) or "ACTION MAY BE BROUGHT AGAINST YOU WITHOUT FURTHER NOTICE".

Apparently "Barry" hadn't made a payment in months. Yet again, he promised to catch up.

And again in December..

Again in February..

And now, although "Barry" continues to post on Facebook, he no longer responds to our direct messages.

Trevor (the latest collection agent) gave mom "Barry's' new phone number. I've tried calling, but he doesn't answer, and he has not yet responded to messages.

The total owing is now $46,502.89 (as at April 24th, 2015).

Because "Barry" occasionally paid small amounts over the past year, Mom still hoped he would honour his debt. But by waiting and hoping this, her chance of qualifying for a re-mortgage dropped, as her credit rating plunged. Meaning her only other option would be to sell her house, in order to pay off "Barry's" debt. My hope is that this campaign will prevent this.