Help me pay off unexpected taxes and get out of debt

Donation protected

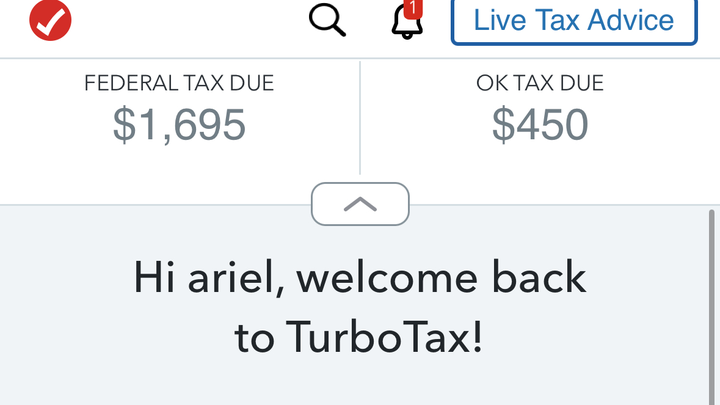

Hello, everybody. For those who do not know, my name is Ariel. I work two jobs, so I typically work 13-hour days five days a week, give or take. This means I spend the majority of my week working, caring for my dog, and sleeping. I do not go out often and rarely treat myself, which I have gotten used to. That being said, I was hoping to get ahead this year. I recently paid off a credit card, my care credit bill is roughly half paid off, and my debt is steadily decreasing. I had such a positive outlook on this year. Then I got my W-2s from both jobs and started filing my taxes, and everything changed. Working multiple jobs and receiving raises this year meant that I should have had more deducted from my paychecks or set aside money on my own. However, I was unaware of this, and I now owe over $2,000 to both the state and the federal governments. Not only was this unexpected, but I am not sure I can pay it off. Yes, the IRS allows payment plans, but they typically require payment within six months. That would still require me to pay more than $300 per month on top of my regular bills. Longer payment plans would have me still paying a fee as well as interest. So here I am doing something I hate to do which is ask for help. I know I should have been more aware of how much my job was taking out and I know this isn't an emergency and we're all struggling right now. However, any assistance would be greatly appreciated so that I can at least get to the point where I can have more manageable payment plans. I have attached photos as proof, but please let me know if you have any questions. Thank you!

Organizer

Ariel Raff

Organizer

Moore, OK