Hello!

Thank you for checking out my fundraiser! Allow me to introduce myself.

My name is Courtney Messina.

Many of you may know me as “Coco,” or even as “Umbra” if you know me through my art.

I’m in my early 30’s, have a long term supportive boyfriend, I love cats, have a special interest in learning about & caring for reptiles, & at the end of the day, I’m an artist!

My favorite mediums are acrylic & watercolor paints, along with pen, pencil, & ink. Below is some of my work

I have some pretty big aspirations to have my own workspace, where I can create bigger & better things!

However, I still cannot afford to move out of my parent’s house due to my student loan payments - now more than ever.

I have never made one of these before, and I admit it’s way out of my comfort zone asking for money - or asking for help…

—however, after a number of painful situations piling on in the last two weeks… I know I need to ask for help.

***

—Let’s Begin with My Private College Loans; They’re Defaulted—

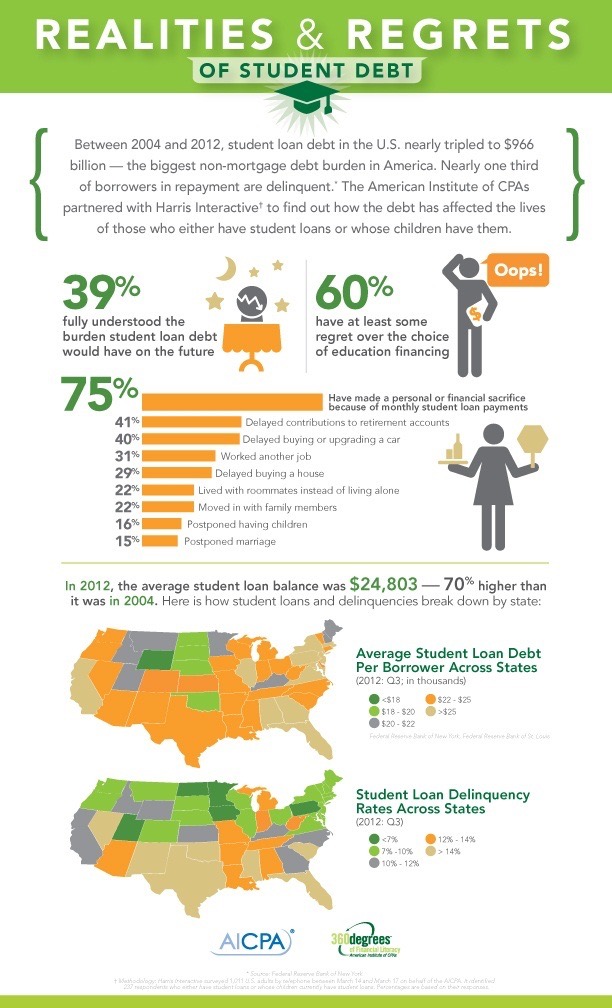

As you may know, it’s May 2025 and student loan collection has begun again.

What you may not know, is that our government, led by President Donald J. Trump, and more specifically the Department of Education ( secretary Linda E. McMahon ), is taking all defaulted borrowers to court.

Please follow the link above to read about the consequences of such immediate and frankly, devastating actions. We are going to see a huge wave of American citizens suffering financially from this move.

Unfortunately, I am one of them.

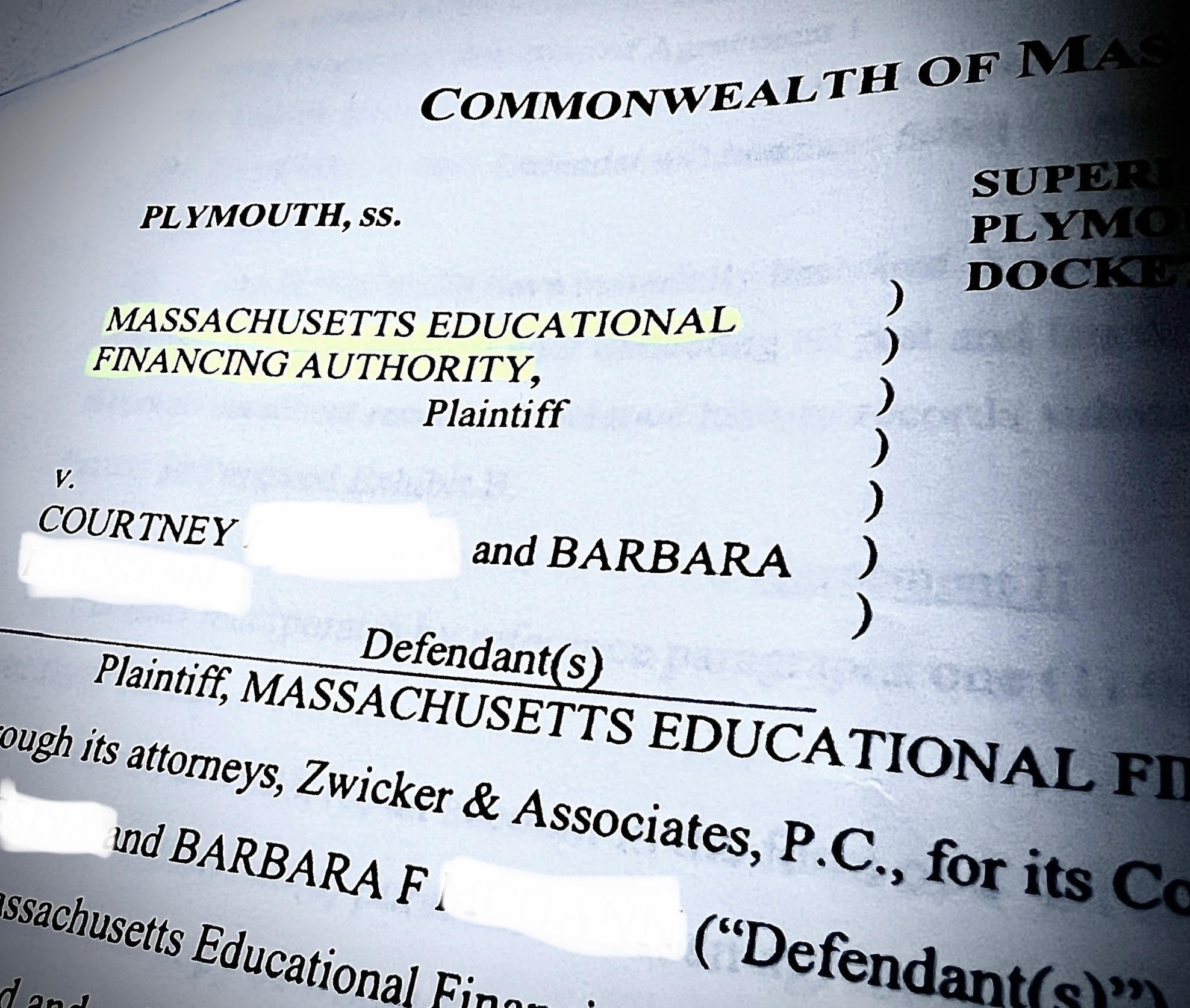

I was served a summons by my town’s sheriff at the beginning of May. They didn’t waste a single breath.

— So how did we get here in the first place? I’ll explain—

In 2013, my Grandmother, Mother, and I secured Private & Federal loans to send me off to attend The New Hampshire Institute of Art (now known as “New England Institute of Art”) in pursuit of a BFA (bachelor’s of Fine Arts).

— Moving forward, these loans would amass to the colossal size of nearly $100,000, despite only attending 2.5 years without graduating.

While attending this institution, some key events occurred that devalued my education, and my ability to find work in my field therefor after.

They are as follows:

- We (students) lost accreditation for many of our classes

- There was a merger going on that left students & staff confused

- No school President for at least 1 full year

- Despite touting having an on-campus therapist, there was NOT one.

- The school nurse was only available briefly, or not at all.

- When a new President was assigned, they told a struggling student, “you don’t belong here”

- We were routinely served uncooked meat/food - had to fight with campus cafeteria staff to recook it for us (cafeteria is paid for by us)

Additionally, while I was attending NHIA, my mental health was unmanaged, unmedicated, and I was trapped in the most abusive romantic relationship of my life (mentally and physically).

Suffering with devastating mental health conditions that are NOT able to be managed is hard enough. Now, imagine being a teenager, having your illness exploited & exacerbated by a controlling partner whose only goal is to manipulate you for their own use - this was my reality during my college years. I’d like to list some ways in which that affected me.

- I needed extra time to pass in assignments. Some instructors were kind enough to allow this. Others weren’t

- My friends had to force me to leave my room, even for food

- Being unmanaged, I didn’t understand my (at this time) undiagnosed mental illness. I spiraled downwards - further every semester. I struggled in every aspect of college

- There was no school therapist to help me with my feelings

- I struggled with severe insomnia & fatigue, causing me to miss more and more class

- I was consistently late to class due to my ADHD and other unmanaged mental health issues

- There was no school nurse available in office when I needed notes to excuse my absences

- I was too afraid to speak to any higher-up school faculty about my struggles due to hearing the cold reaction the student mentioned earlier had gotten

- I began having fainting spells, especially when showering - that I could not get notes for due to the nurse being unavailable

These points amassed, I could not pass all of my classes during my sophomore year. I was forced to drop two or three classes, which left me short of the amount of classes needed to remain living on campus (a state away from home). I had no choice but to pack up on extremely short notice, and leave my dorm for home. I was incredibly crestfallen and devastated. I felt like a failure to my friends and family.

—What Happened with the Loans??—

Well, when you’re a teenager suffering from things like “mostly” undiagnosed (at this time) ADHD (inattentive type), Autism, PTSD (recurrent), Major Depressive Disorder (recurrent), Social Phobia (social anxiety), alongside dealing with the pure horrors of being a “gothic” teenage girl with too many hormones living in a small conservative town — there is a sad, but common truth among myself, and others who grew up like me;

—we didn’t expect to have a future, and thus; we didn’t think about one.

Personally, I never thought about the loans as a teenager.

I wasn’t there when they got taken out. I wasn’t a part of the process at all. My mother & grandmother applied and were awarded any and all loans. All aspects of my schooling was handled by somebody else. In fact, everything in my entire life was handled by somebody else up until well after college.

Money was never something I had in my own hand growing up because I could never understand it, and I was too socially anxious to get any jobs or leave my house to work.

Just as all numbers had evaded my cognition my whole life, the loans were nothing more to me than incomprehensible things that my parents would take care of (whatever that meant) the same way they took care of everything else as I was growing up (I assumed). Like all things, they’d find a way to make it work out. And if I had to deal with them, well… they couldn’t be that bad… right? I mean, our parent’s all had them and they still bought houses and had a future! (How little I truly understood at this time was devastating)

After starting college and becoming jaded, student loans would only evolve into a joke between classmates while walking in the snowy, unpaved road to class; when a car might swerve too close,

“Hit me, please! Pay for my tuition!”

But believe me when I tell you, it was jarring beyond words to suddenly be handed my first bill, and have it read, “ONE-HUNDRED, THOUSAND DOLLARS.”

— I Paid Until I Couldn’t. When I Defaulted & Why—

I worked a retail job at Michael’s Arts & Crafts for most of my teenage life, earning minimum wage & being overworked beyond belief by a boss that despised me. I moved on to two more jobs after that, going from $7/hr at my start in 2011, up to $17/hr.

The payments required for both my Federal and Private loans began somewhat affordable, from what I can recall.

I had a backlog of refunds from the school at the time, and had been overworking at my job. I worked full-time at Michael’s for as long as I could before being told to step down from the position for being unable to handle the workload quickly enough.

But as time ran on, the payments got higher and higher, and my money began to dwindle.

As I struggled to pay, I would spend many nights on the phone with MEFA (the lender for my private student loans) trying to work out repayment options that I could afford.

We settled on a Modified Repayment Plan (click here to find out what that is) that I could somewhat afford - for awhile.

Once this ran out, I would start receiving phone calls and notices of missed payments - even when I had payed what I could.

I quickly noticed a pattern; It wasn’t enough.

—Fast-forward to sometime in 2023—

I had spent the better part of the last few years stressing over paying specifically the private loans from MEFA. I would shovel everything I had into them, because I thought that was the morally “right thing to do.” That’s what I knew would make my family happy with me, but it wasn’t making any dent in the loans themselves - or stopping the rate of MEFA’s harassment.

MEFA left my cellphone full of voicemails, flooded both mine and my Grandmother’s mailboxes with paper bills, and my Grandmother was furious about the state I was leaving her credit score in by “letting” the bills pile up.

And because my grandmother was lashing out at my mother daily over me, my previously wonderful relationship with my mother suffered in-turn. Sometimes we would fight all day long, nearly every day. Usually about how much I should be working in her opinion vs how much I could actually mentally and physically work due to my disabilities. The ways in which a vile thing like money can destroy a family is pure evil.

At a breaking point, I made one final attempt to call MEFA in late 2023 or so. I wanted to just be bleedingly honest with whichever agent had the displeasure of hearing my sob story. I didn’t know what else to do than to just tell them the truth: I had little money, but I was still willing to pay. I just couldn’t afford what they were asking at $400-$600 and rising slowly up to $8/900 a month at the time.

So, I made contact with a gentleman. He was robotic & sounded sick of his job. He explained to me that I had already exhausted all repayment options available to me. So I told him exactly what I said above, and he just went silent, and repeated himself. I was so fed up and frustrated - feeling let down after hoping this might be the day this gets sorted out for good.

I tried to hold back my tears, but I’m a cryer when in conflict. So I broke down on the phone with this man, pleading with him, “What am I supposed to do? I can’t afford these bills?”

All he had to say to me was, “I don’t know.”

That was the last time I ever made or accepted a phone call from MEFA. I started saving all of their mail for my records, but I hardly gave it a second glance.

MEFA proved to me that they were not willing to help me pay them.

However, that wouldn’t be my final straw with MEFA.

—that would come when I would do something incredibly detrimental to my own quality of life in order to appease my family.

I wanted so badly to prove to my mom and grandmother that I WAS, in fact, doing everything I could. I wanted to prove to them that MEFA didn’t want just any amount of money; they wanted ALL of it, or none of it… so I had a plan.

When I received my tax refunds that year, I paid my few bills & then promptly dumped them into my private loans. They vanished, as if they had never existed.

I waited, hoping for a miracle, but knowing better in the back of my mind what was to come.

Only a few days later, I received a notice in the mail reading, “DELINQUENT,” in startling red ink for the world to see.

Tears welled in my eyes. That was that. I couldn’t do it anymore. MEFA was not willing to make paying them accessible to me, they didn’t want my money if they couldn’t have massive amounts that I didn’t even make.

From then-on, I felt I had no choice but to shift my focus to my mental health - which had taken a massive plummet from the loan situation, among other things. I applied for Social Security Disability as well, getting denied over the course of two years. I will try again.

Up until 2024, my mother was still shoveling hundreds of her hard-earned dollars into this horrific loan. Money that has done nothing but vanish into a starving black hole due to the massive interest rates.

—Where Are We Now?—

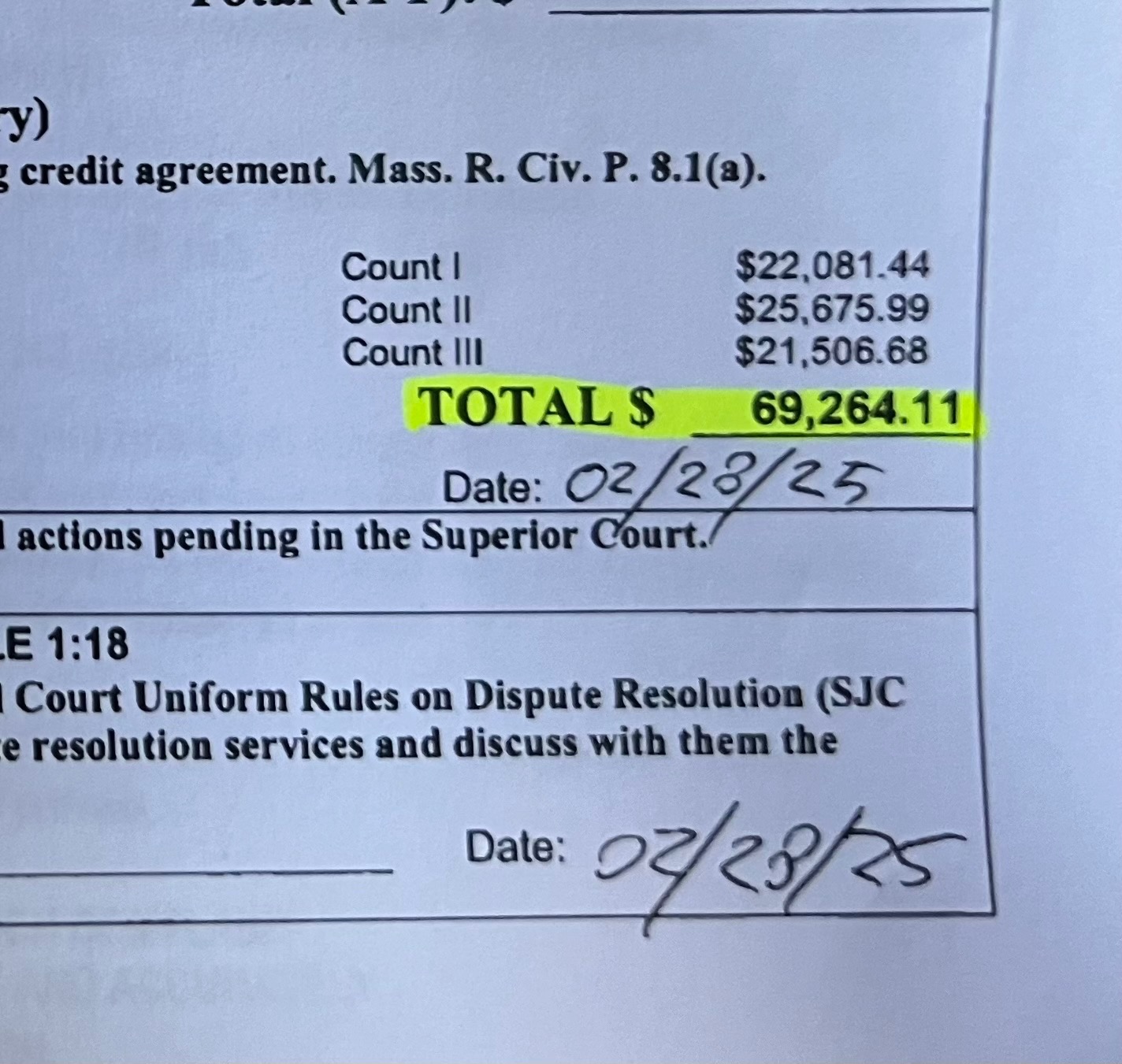

In short, MEFA has summoned me to court regarding my DEFAULTED PRIVATE STUDENT LOANS. They wish to gain a judgment in the amount of $69,264.11

This is money that my Grandmother & I simply DO NOT HAVE.

- I am only able to work about 10-15hrs a week making $17/hr due to my mental and physical health. I will gladly go into detail about any of that information should anyone have questions regarding my ability to work. I am an open book. Not all of my illness’ have been listed in this article.

- My Grandmother is not able to pay the loan, as she is 87 years old, does not work, and is caring for & completely financially supporting her adult (and highly dysfunctional) son. I don’t want her paying it anyways.

Here’s my Mom & Nana for tax~

—Next Steps—

After getting served beginning of May, I found an attorney who specializes in student loans and student loan debt. Researching him online & corresponding with him via email for a few days proved to me that he knew his stuff, so I went ahead and hired him for a consultation.

He had very promising plans and better news than I expected to hear, but the road could be long and full of challenges. That’s why I personally believe keeping him around for this process is necessary to achieve a favorable outcome against MEFA regarding this private loan.

—How You Can Help!—

Asking for help is not my strong suit, however, I am at the very end of my rope at this moment - and so is my family.

Both emotionally & financially. A whole lot has been going on, unfortunately.

As you may already know, a few days ago, my father suffered a heart attack. During this event, he was pronounced clinically dead two times during his ambulance ride to the hospital. He did survive and is doing well, possibly even coming home tomorrow! But the medical costs are incredibly high. They had to give him four stents, are talking about more surgery, ongoing cardiac rehab, a possible pacemaker in the future, and he has been in the ICU and cardiac ward for a few days now.

(From left to right, my mom, Chip Coffey, and my dad)

It’s SO incredibly important to me that I don’t have to ask my family for money while they are already dealing with this emergency.

- I drained my bank account until it was negative, having to borrow from my mother when I hired my attorney for his consult. This costs a flat $385 fee/hour

- If I want to retain him throughout the trail, his fee is a charge up front of $2,000-3,000, hence my donation goal!

If anything extra is leftover, it will be used to reimburse my mother for her money spent to help me with this situation, and to help her with medical bills for my father.

-I will be keeping track of receipts to show proof of where your donations go!

If you’ve made it this far, and read all of that - thank you for taking so much time and energy out of your day to lend me your support. I know that we are all struggling with the state of the world, which made creating this feel even more difficult, but the fact that you chose to care about my situation anyways means the absolute world to me. <3

Even if you can’t donate, please know it’s okay! Sharing is JUST as good!

You’re the best!

Always,

Coco & family

(Ps - this was not written with ANY AI. It was written painstakingly, by hand, by myself. Thank you for reading)