Dragged 15 Feet by a Sunfire — Then Dragged 9 Years by TD Bank

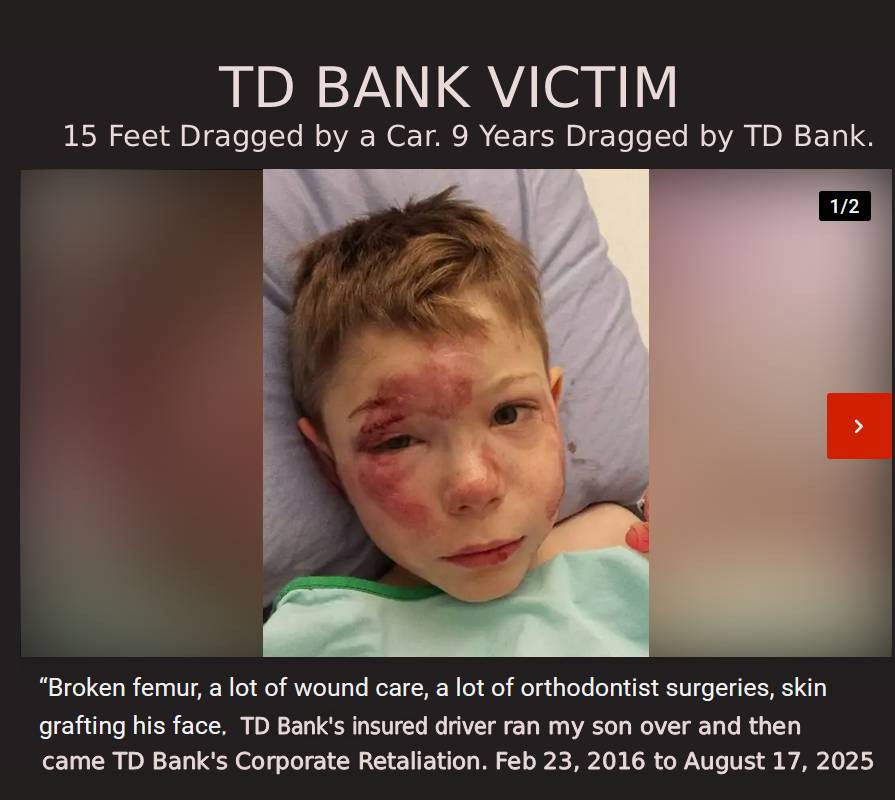

In 2016, my son Ethan was hit and dragged 15 feet by a Pontiac Sunfire. The physical trauma was only the beginning.

TD Bank and TD Insurance—both owned by TD Group—controlled his injury payout, our mortgage, and my credit reports. That conflict of interest turned us, the victims, into their hostages.

⚠️ What They Did

Withheld Ethan’s accident settlement from the provincial trustee (where, by law, it belonged).

Red-flagged my credit for 9 years, blocking refinancing and forcing us into poverty.

Downgraded me from “General Manager” to “caretaker” on mortgage records without my consent.

Stalled Ethan’s lawsuit for 6 years.

Alberta Works refused support until I liquidated all assets after my EI expired.

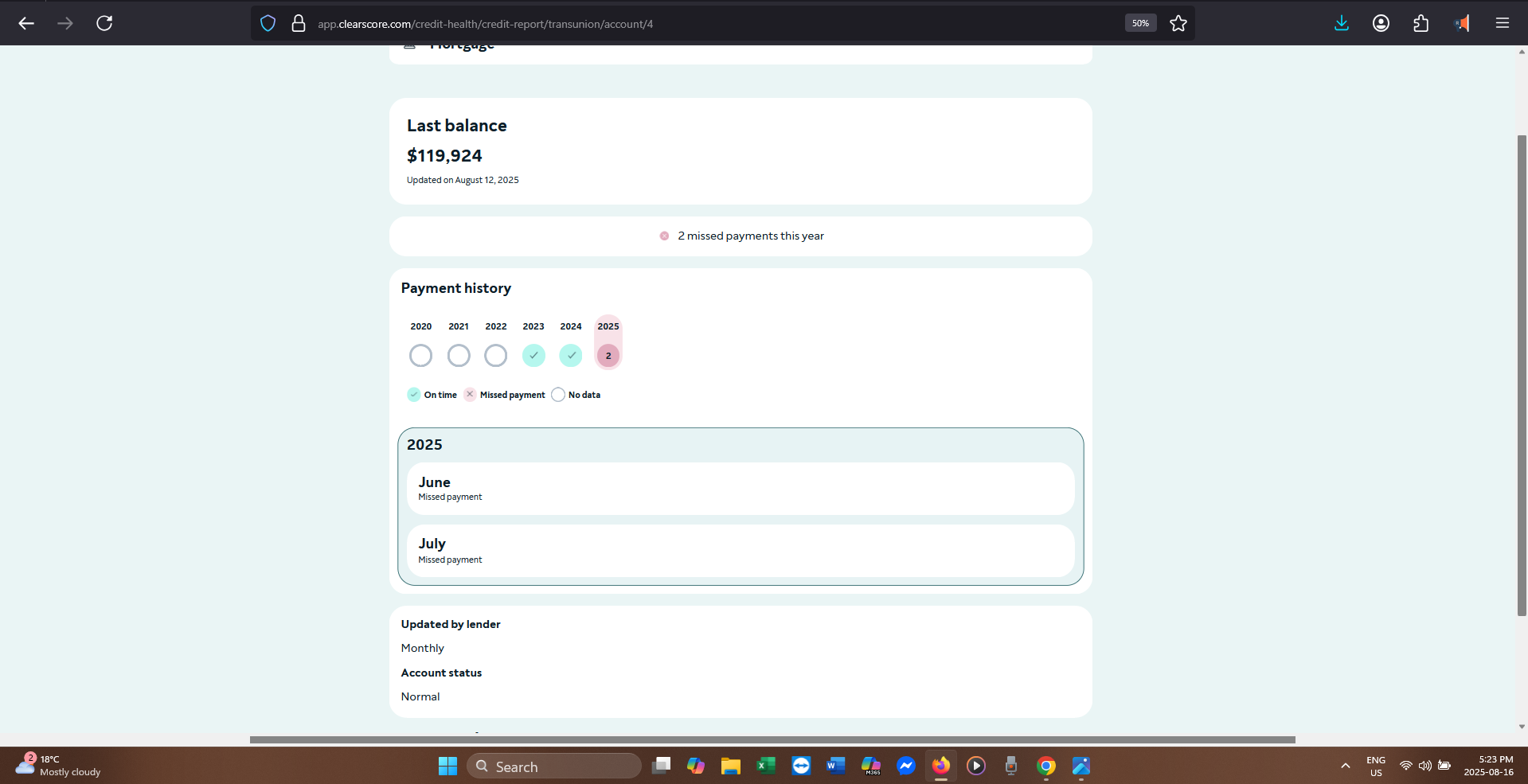

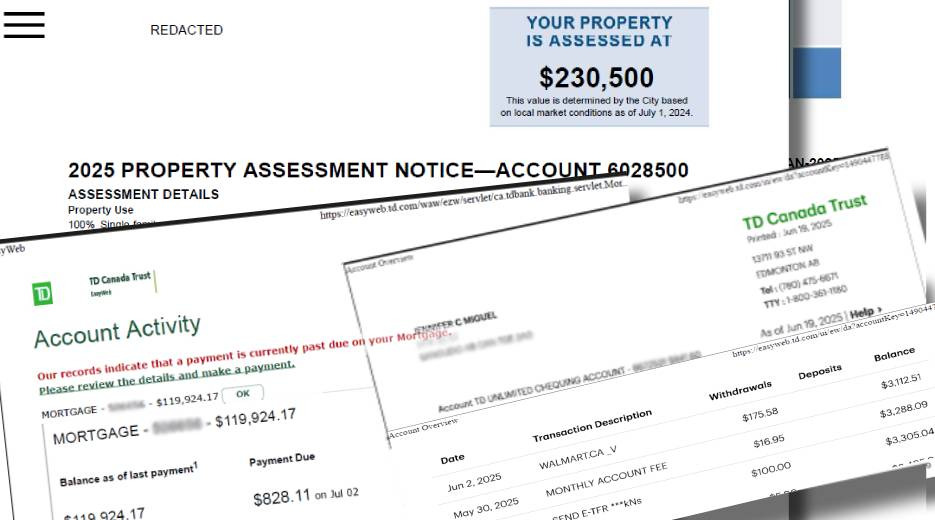

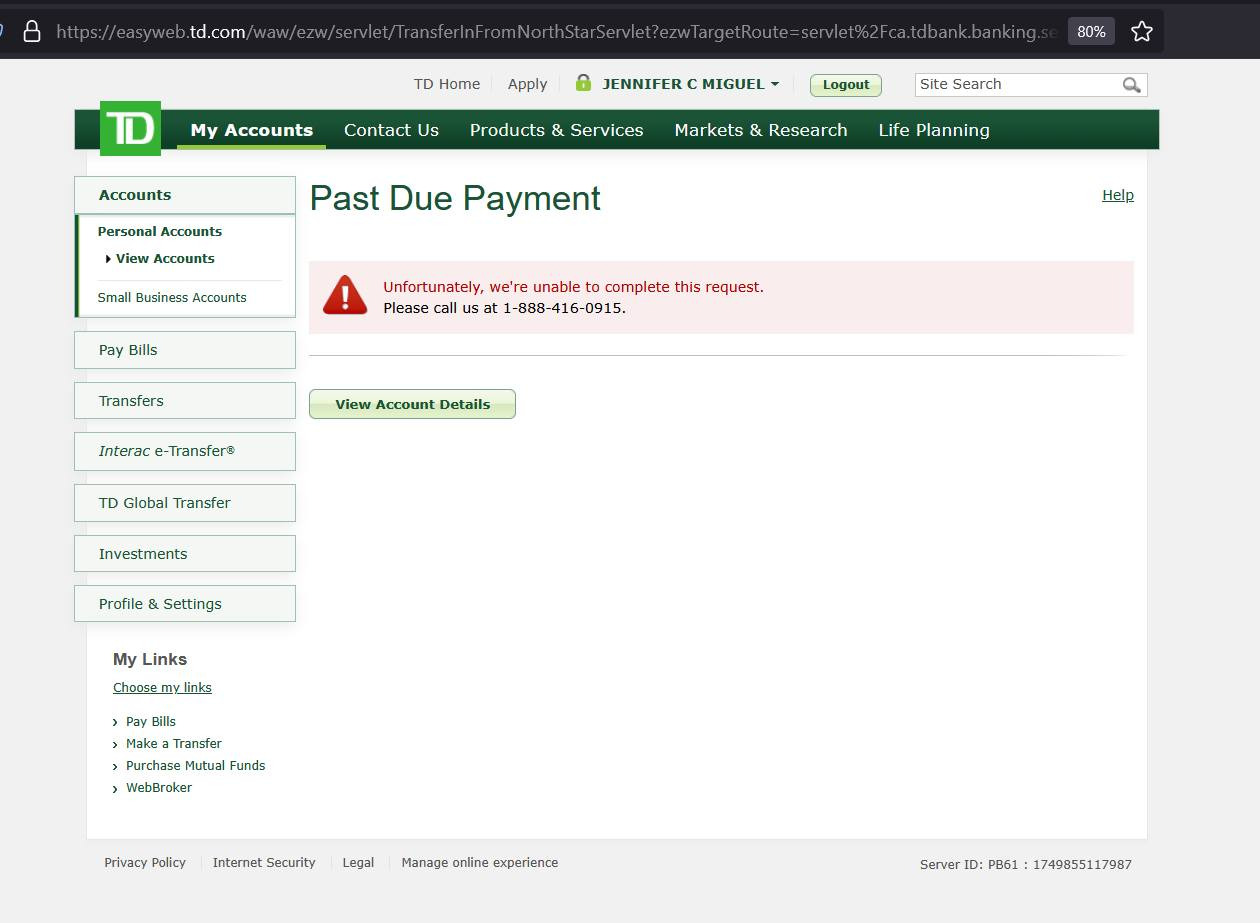

Then, 3 months before Ethan’s payment, TD blocked a routine $828.11 mortgage payment—despite $5,000 in our account.

On June 2, 2025, they manufactured this “default.”

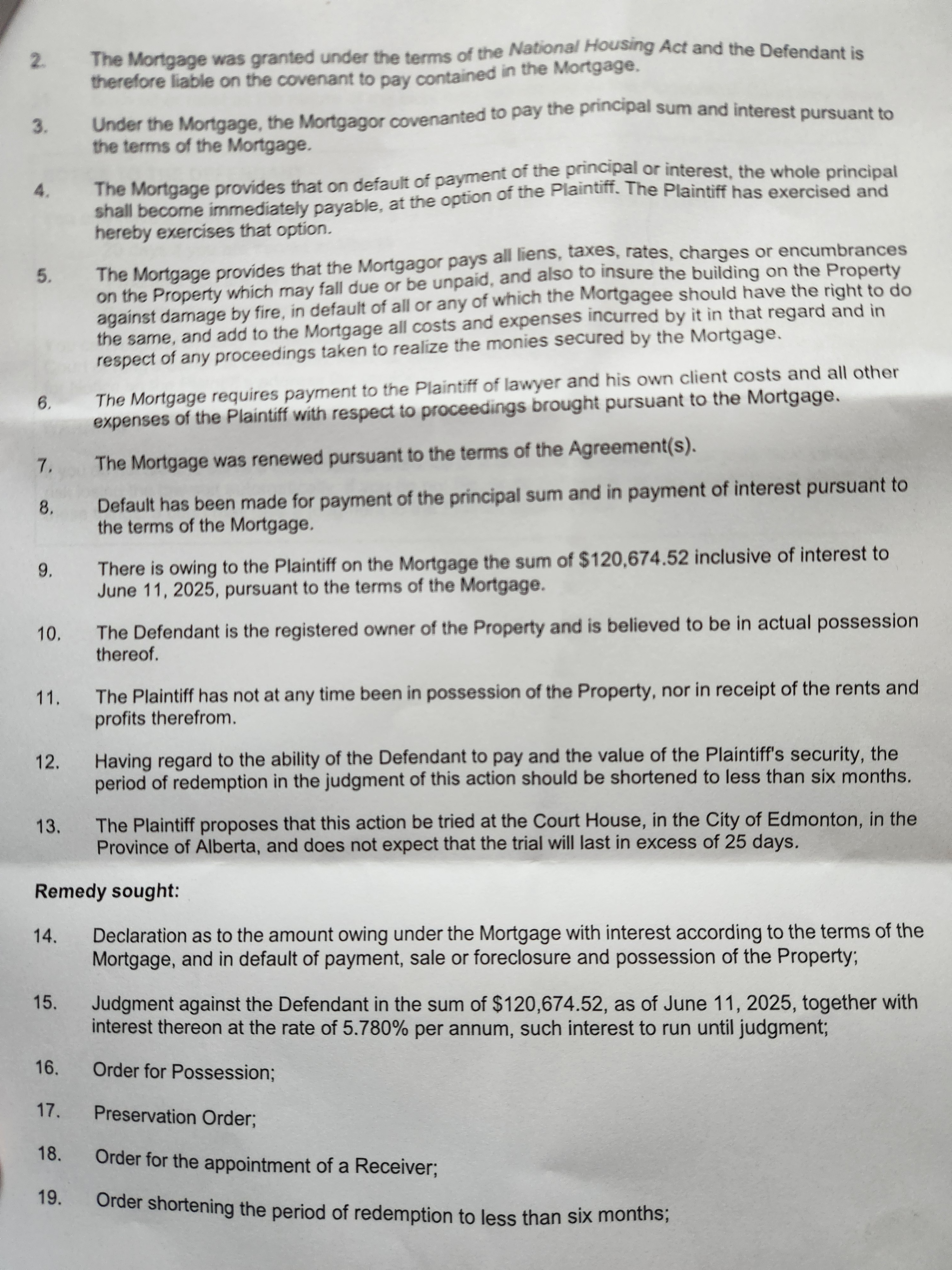

On June 11, 2025, they filed foreclosure.

Our home was tax-assessed at $230,500. We owed $119,000. Yet they now demand possession plus $120,000 more in cash, while holding Ethan’s settlement hostage.

Why You Should Care

This is what happens when one corporation controls insurance, banking, credit reporting, and mortgages.

When TD’s auto insurance client hit my child in front of his school, TD Bank got to decide how much his life was worth—and then used its other divisions to choke us financially.

Breaking the Welfare Mom Stereotype

I built everything we had. Two home purchases. Fifteen years of perfect mortgage payments. I worked hard.

Then one of their drivers hit my son, and TD dismantled everything using the very systems they control.

I’ve heard the sneers:

“You’re riding your son’s accident.”

“Maybe you should’ve taught him to cross the road.”

“Maybe you should’ve managed your money better.”

But that ignorance is exactly how the system survives—until it happens to your family.

About That “Alberta Law” You Trust

The driver who hit my son?

She paid a $550 fine for failing to stop at a crosswalk.

She drives a new truck today.

We lost our SUV, our jobs, and nearly everything we had.

Where Your Donations Go

Legal filings and court prep to fight TD.

Basic survival while we stop the false foreclosure and unlock Ethan’s frozen settlement (he turns 18 soon).

Public awareness of this conflict-of-interest model—where the same company can injure, delay, and foreclose.

✊ This isn’t just about us.

No bank should be allowed to control both auto insurance and mortgages.

Their victim becomes their hostage of corporate retaliation.

Why I asked for 15,000? I already paid thousands and I am too poor to pay the next 10-15 thousand my lawyer demands to get this case in front of a judge.

Help us fight back.

Help us expose this.

Share. Donate. Speak up—before it happens to someone you love.