CAREGIVING SHOULDN’T LEAD TO HOMELESSNESS

Donation protected

On December 28, 2023, we ALL lost Mary Lou. For her son and registered caregiver, the loss was quite a bit more comprehensive, and included: Mom, job, health insurance and shared residence.

Friends and family,

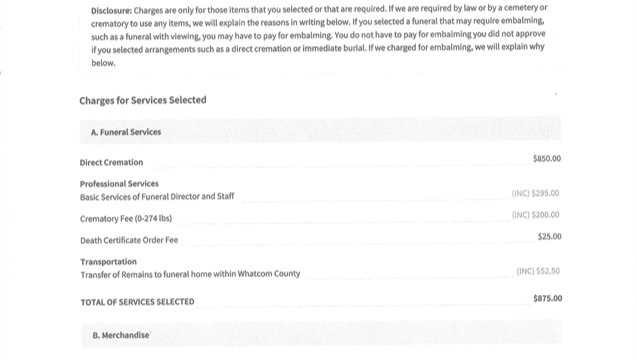

Now that my mother has passed away, my brother must move out of the apartment that they shared, and find a one bedroom apartment. He has the expenses of my mother’s funeral to contend with, which includes her cremation, urn, the expense of traveling from Washington to Massachusetts with my mother’s ashes, and providing a Roman Catholic service, reception and burial for our Mom. A particularly daunting task, considering there are no insurances to assist financially.

And yes, I ask you to get behind me and support this cause, for two worthy people, our mom, and my brother.

If you have been to our mom’s home, chances are, my brother has fed you and served you drinks. If not, when you meet him, he will. Likewise, our mom has provided a temporary home, to friends of mine, and my brother’s. We have always been willing to share whatever we had with friends and family; and felt empowered through sharing and positively impacting other human beings.

As will you, in helping my brother.

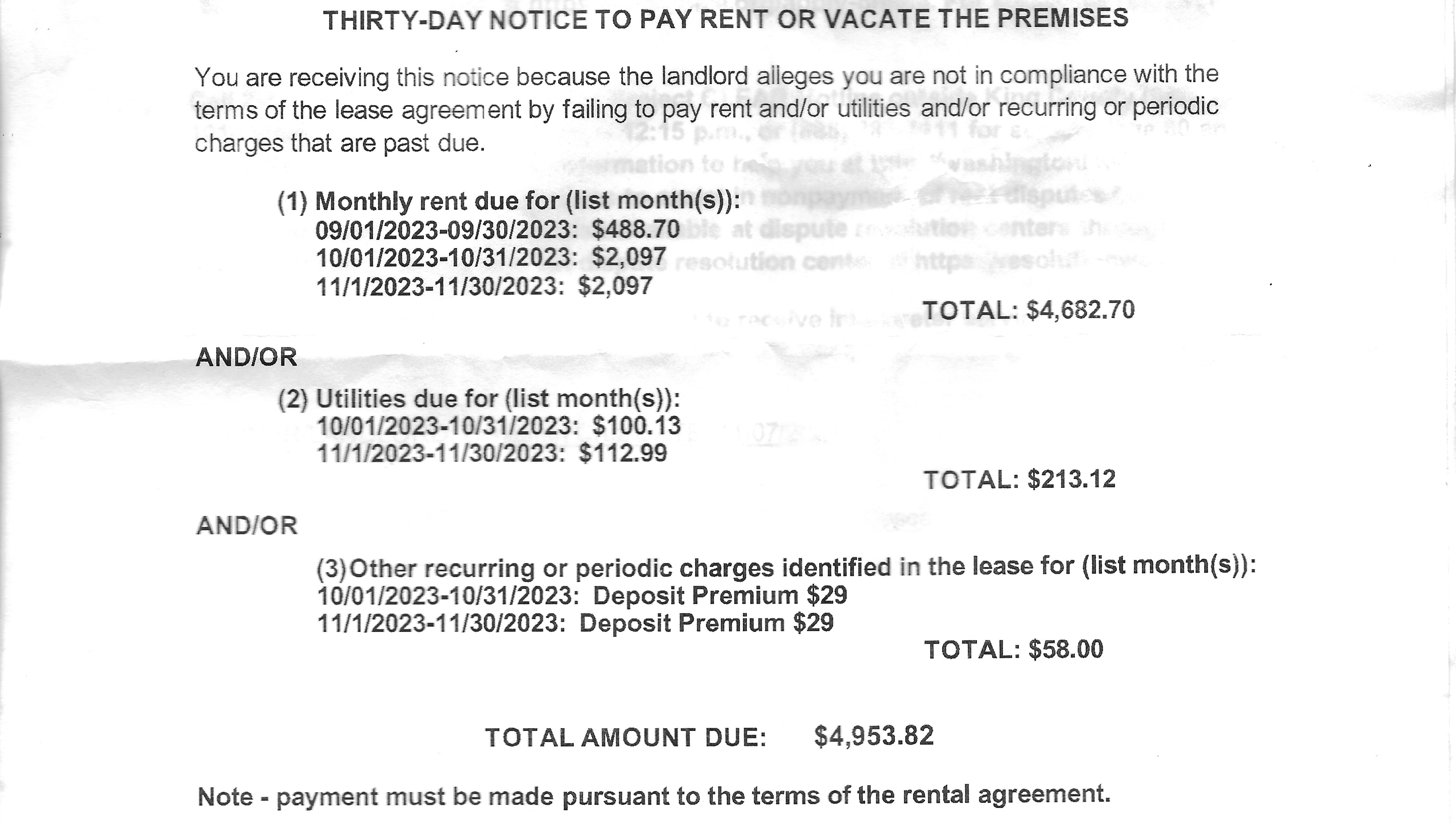

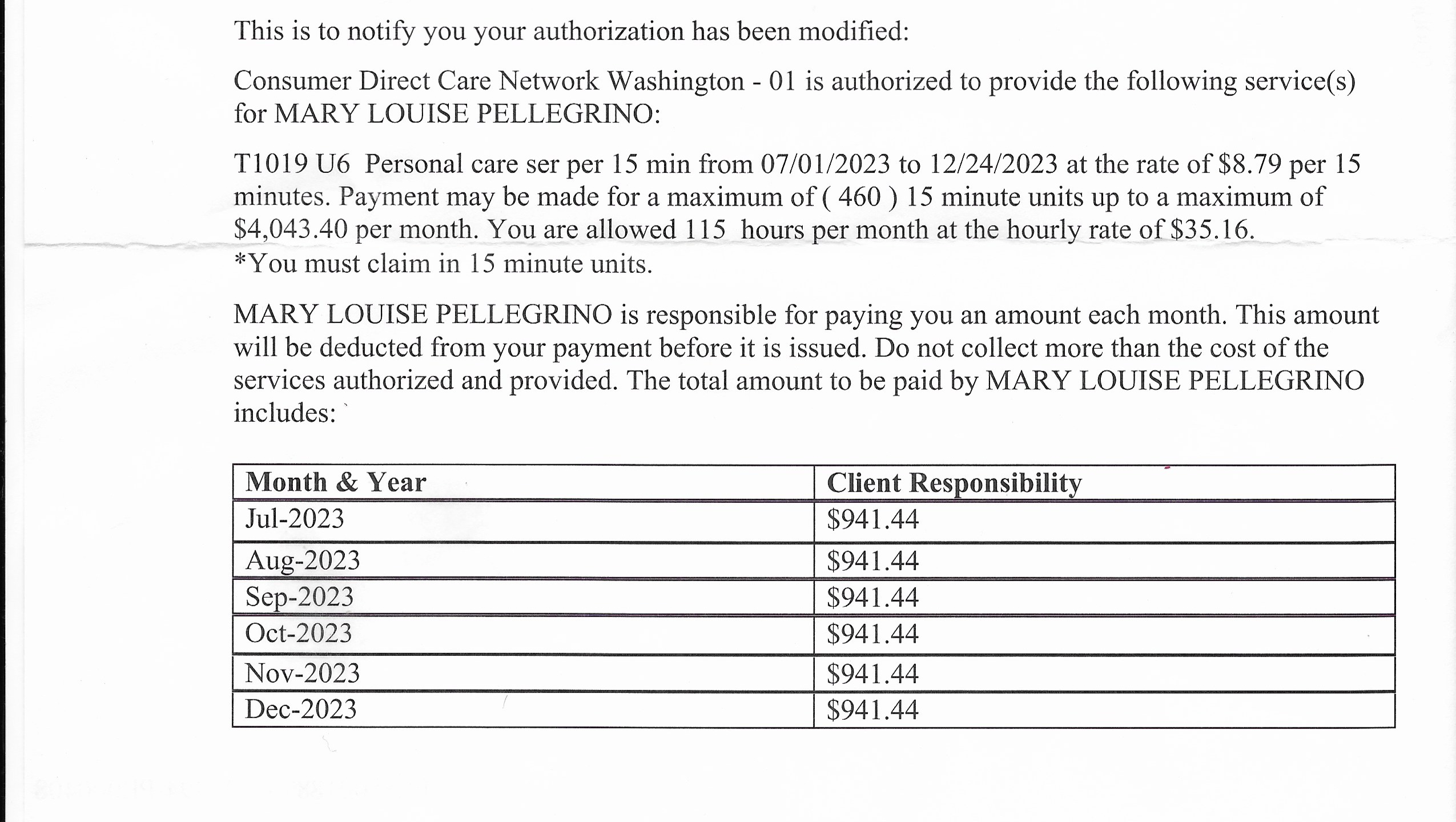

My brother had many household expenses to pay while caring for my mother. My mother and brother lived from paycheck to paycheck for the past decade. One of the many expenses my brother had to deal with was paying $1,000.00 a month BACK to the Washington State Department of Health Services. The same agency that issued HIS paycheck, was also THEIR creditor. One of the many injustices and financial traps laid for those wishing to keep a parent OUT of a nursing home.

On average, the caregivers’ uncompensated expenses—things like housing, health care, and transportation—add up to more than $7,000 a year, pushing almost half of them to say they’ve suffered financially. Many feel they have no choice but to withdraw money from savings accounts or retirement nest eggs, take on debt, pay bills late, or scale back on their retirement contributions.

The report comes as the need for caregivers will likely skyrocket. Each day, about 10,000 baby boomers turn 65, and they’re living longer than ever. Life expectancy has risen by 17 years since the Social Security program debuted in 1935. The report also reveals that caregivers have lower levels of financial assets and higher levels of debt compared to those who don’t care for loved ones.

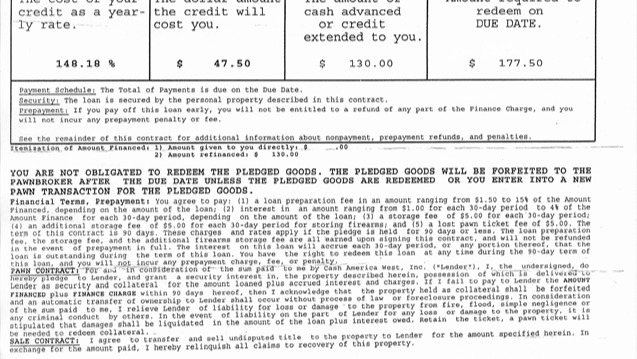

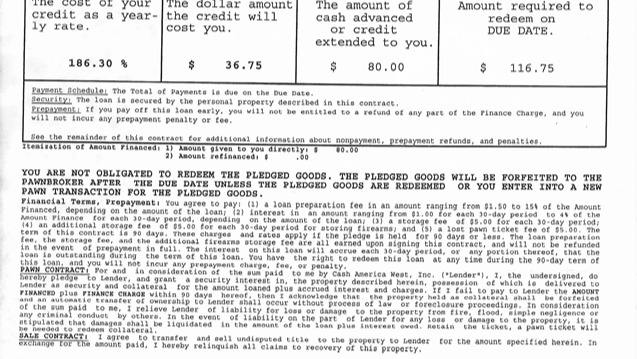

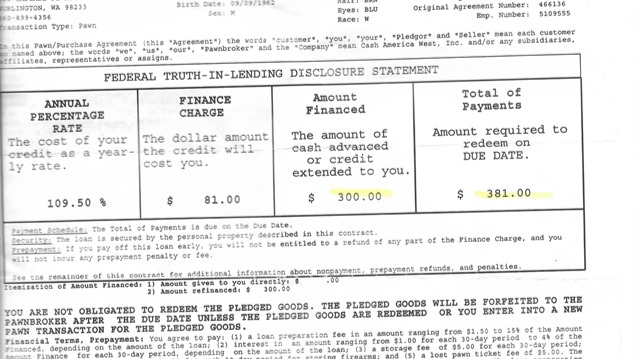

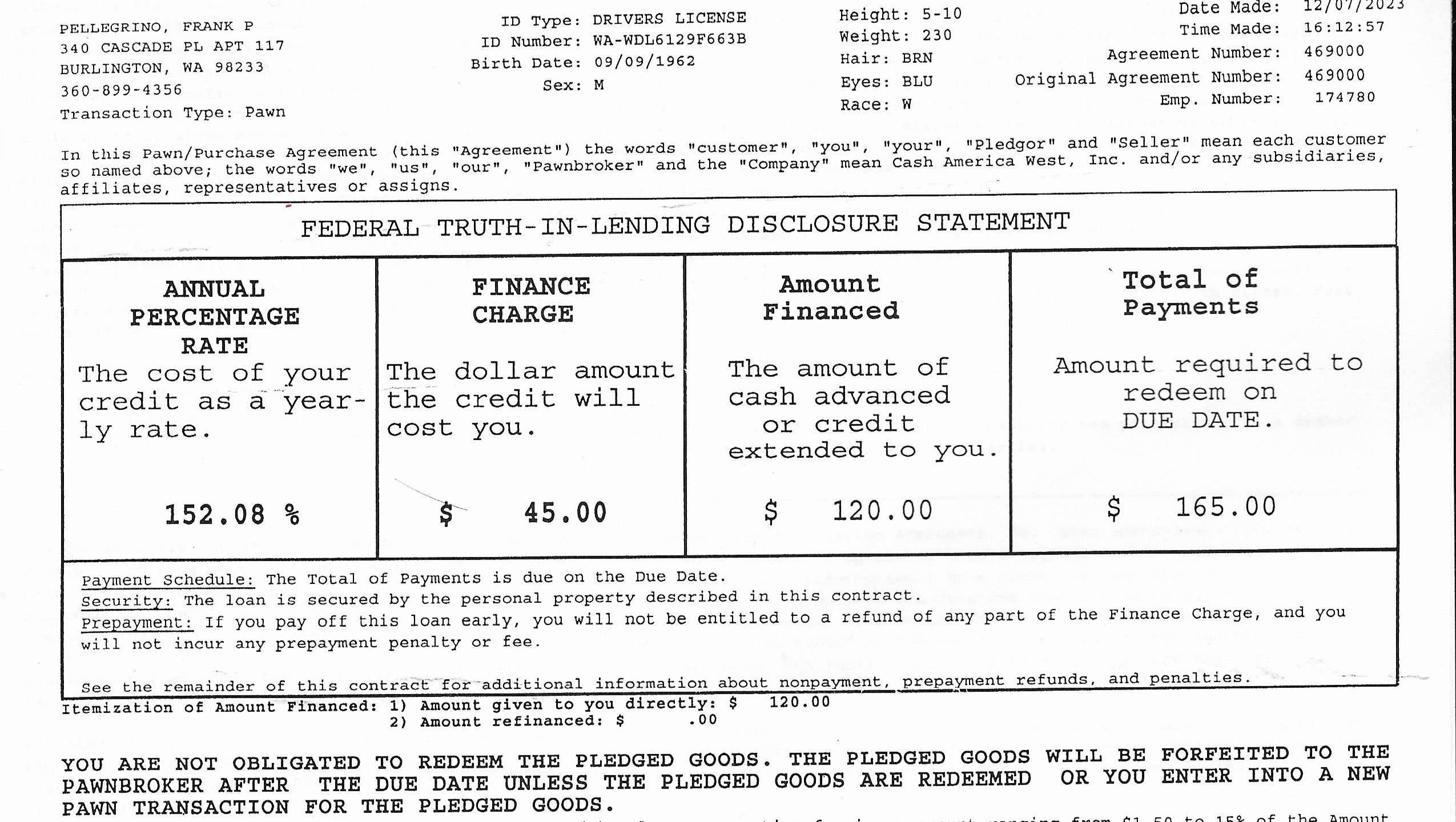

My brother did everything he could, to afford to keep our mom at home, and OUT of a nursing home. My brother got the money together by regularly cashing in all of his accrued sick leave, and pawning whatever valuables he could; paying medical expenses one month, catching up on rent, the next.

We shouldn't have to make a choice between financial devastation and providing quality care. People are living longer but with chronic health issues. “At the same time, older Americans are increasingly likely to file consumer bankruptcy, and their representation among those in bankruptcy has never been higher.”

Paul has to vacate the apartment he shared with our mom by Feb 1st. At the moment he is packing, sending family trinkets to relatives, packing, and looking for a one bedroom apartment. The corporate vultures are circling over him and my plan is to get him out of there.

Won’t you help - my brother?

-Peggy (Pellegrino) Rodriguez

Organizer

Frank Pellegrino

Organizer

Burlington, WA