Mike's Two-Year Vehicle Saga

SAGA - PART 1

Almost exactly two years ago today (to be specific, on May 12, 2023), my trusty 2010 Volvo XC60, with around 225,000 miles on it, was facing almost $3,000 in brake repairs. Not wanting to sink that much into a vehicle which was fast approaching the quarter-million mile mark (and not having the $3,000 to make the repairs happen), I shopped around and found what seemed at the time to be the PERFECT vehicle... a 2018 Ford Edge SEL with just over 40K miles.

After working hard over the prior 3 years to get my credit back in order after Phyllis' ultimately losing battle with pancreatic cancer, I was able to get into the Edge with only $1,000 down with affordable monthly payments. As this was the first MAJOR purchase on my own in close to 15 years, I even went so far as to purchase an extended warranty (which I was assured would cover everything - bumper to bumper - until the car had well over 100K miles on it). I figured the extra $2800 or so tacked on to the price of the car was well worth it.

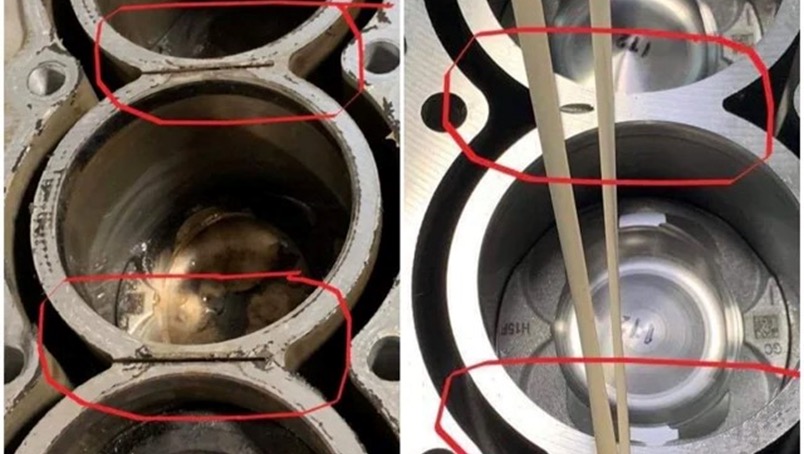

Flash forward almost exactly one year. After almost 40K miles of trouble-free driving, I started the Edge, looked into the rear-view mirror and all I saw were thick clouds of white smoke. I immediately had it towed to the nearest Ford dealership who confirmed my worst fears - coolant had intruded into the cylinders due to a poorly designed head, resulting in a cracked block. Ford, well aware of this problem, had previously issued a TSB (which SHOULD have been a recall, but as of yet still hasn't been elevated to that level despite thousands of vehicles being affected) that called for one solution - replacement of the long block (quoted at just under $9,000). No problem, I thought... I had wisely purchased the extended service plan! SURELY they will cover the repair (less my $100 deductible)... right? WRONG!!!! Buried in the terms of the contract, was a clause that specifically dealt with long-block replacement. They would ONLY cover long-block replacement if the failure of the block was due to the failure of an internally lubricated component. As the coolant intrusion was caused by the failure of the head gasket (due to poorly designed coolant channels on the head), they refused to cover the repair. Furthermore, I was 20,000 over Ford's default drivetrain warranty for 2018 models, so Ford refused to cover it on a goodwill basis.

There I was, with a vehicle that wouldn't run, unable to get it repaired. I made a difficult choice and called the finance company, told them what happened... and advised them to come pick up "their" vehicle, as I would no longer be making the payments. At that point, I owed over $24,000 on it. I am in the process of negotiating repayment on the substantial deficiency balance, which has done a number on my credit score (essentially driving it down below 500, or below 400 - depending on which bureau you ask).

SAGA - PART 2

For the next 4 months or so, my girlfriend allowed me to use her spiffy (new to her) 2023 Kia Soul while she was at work every afternoon/evening as I was trying to find a suitable replacement vehicle. This enabled me to drive for Uber/Lyft to generate much needed supplemental income... unfortunately, this also started to pile on the mileage on her car. She also needed to have a second back surgery during this time (her first one being February), which resulted in her being out of work for almost 3 MORE months (and, sadly, also resulted in her losing her job).

Due to the voluntary repossession on my credit file, I was/am up against a huge wall when it comes to financing a vehicle. After trying everything I could to come up with some sort of a large down payment, I reached out to a "friend" of mine who I was hoping could lend me a few thousand dollars on easy terms. He had, after all, recently sold his business for a tidy sum, had moved to Columbia, and was constantly regaling me with how inexpensive it was to live there and how he was living like a king. When I asked him for the loan, he had an even BETTER idea... he told me that although he had brought his Porsche to Columbia, he had kept his 2020 Mazda CX9 in Delray, to use only to tow his boat on his infrequent visits back to the US. He told me that when the lease was up he bought it from Mazda outright, and it was just sitting there, collecting dust. He said "How does $100 a week sound?" Well, it sounded like music to my ears - instead of having to borrow money from him just to make a down payment on something, and then having to make payments to him AND the finance company (between the two I was looking at around $600+ a month), it seemed like all my problems were going to be solved for $100 a week! Well, we came to this agreement on Tuesday, 11/19/24, and I was on cloud 9 as my girlfriend drove us the 250 miles from Ocala to Delray Beach the next morning to pick up the Mazda... it certainly felt like I had a LOT to be thankful for on this Thanksgiving Eve. As we sat eating breakfast overlooking the sunrise at Captain Hiram's resort in Sebastian (the halfway point between Ocala and Delray Beach), we both agreed that God was looking out for us and made a whole lot of moving parts come together magnificently.

AND THEN, THE WHEELS STARTED TO COME OFF (pun intended)

Things started to feel a little "off" when we arrived at the shop where the vehicle was at. My "friend" had the rear brakes and battery replaced, to the tune of $800.39. The manager there wouldn't release the vehicle without payment (makes sense), even though my "friend" (according to the manager) always made good on his invoices. Naturally, I attempted to call my "friend" (as did the manager) so that he could get his CC info for payment. For several hours, both the manager and I attempted to make contact, to no avail. I only had around $300 to my name at that point, so I texted my girlfriend and asked her to lend me the additional $500 - assuring her that as soon as I spoke to my "friend" he would send me what I was about to lay out on his behalf. I couldn't see any reason why that wouldn't happen later on that day, or at the latest the next morning. So, on that assumption, I paid the invoice and started the 3 hour drive back home to Ocala. My "friend" finally returned my calls at around 9:00pm, and sounded shocked that I had been able to pay the invoice and was in possession of the car. He asked how much he owed me, and I told him $800.39. He assured me he would send it to me the following morning, asked how the car was doing and if I needed anything else from him. I told him the only thing I would need was for me to be added to his insurance so that I could drive legally for Uber/Lyft. I told him to let me know if that had any impact on the monthly insurance premium and that I would reimburse him that on a monthly basis. He said he would let me know the following morning - the fact that it was going to be Thanksgiving was brought up, to which he said it is all done online anyway and not to worry. We wished each other a Happy Thanksgiving, and I thanked him profusely for coming to my rescue in such a large and unexpected way.

Thanksgiving came... Thanksgiving went.

Black Friday came... Black Friday went.

Cyber Monday came... Cyber Monday went.

Christmas came... Christmas went.

New Years Day came... well, you get the pattern by now.

No contact from my "friend". No reimbursement from my "friend" (which pissed off my girlfriend immensely, as she had lent me part of her mortgage payment. Thankfully, I had invoices coming in before she needed to make her mortgage, so I was able to cover it.).

Finally, I decided to stalk his Facebook, figured out who his girlfriend was, and using Google translate sent her a message, asking her to have him give me a call about an important matter concerning his car in Florida. Literally 25 minutes later I received a call. He told me he had gone on vacation in the mountains, and had no cel reception. I told him to don't worry about the reimbursement for the repairs, I was just withholding the weekly payments for another two weeks to make us even. He said "works for me!". I then asked him about getting me added to the insurance so I could use the vehicle for rideshare purposes - he promised me he would do it online later that evening when he was in front of his computer. I told him to make sure I had something the next morning, as I had already missed out on Thanksgiving, Christmas and New Years opportunities (essentially lost out on around $3000 over the holidays).

It shouldn't take any great detective skills to figure out that I didn't hear back from him the next day. But it gets even more interesting:

Somewhere around the middle of February, I get pulled over. Not for speeding, not for any moving violation... I was pulled over because my friend's license had been suspended for not having insurance coverage on the vehicle! In fact, had HE been driving, the tag would have been seized, he would have been arrested and the vehicle would have been towed and impounded. Through some strange quirk in the laws of the state of Florida, the officer said "This doesn't affect you in any way, so please let your friend know he needs to straighten this out. You'll probably keep getting pulled over, so unless you LIKE being inconvenienced all the time, you should have him do it sooner rather than later!"

Well, what had started out as me being pretty annoyed at the whole situation had now grown to me being ANGRY. I did some research, and found out that I could purchase what's called a "non-named owner" insurance policy. Even though I was NOT the owner of the vehicle, I was able to purchase a policy that brought me into Florida's PIP/Liability minimum coverage requirements, thus satisfying Uber/Lyft requirements and enabling me to earn money via rideshare again.

So, I did. It was now late February, and I was back in action on both platforms... FINALLY.

Then I remembered... my birthday is in March. March 11th. My "friend's" birthday is also in March... March 7th. Time to start pestering him about renewing the registration. Begin daily text message campaign. Well, if you've been paying attention, you know the outcome.

March 7th comes and goes - no response. Uber and Lyft both suspend me from their rideshare opportunities. March 8, 9, 10, 11 (My Birthday)... all the way through the first week of April. Multiple messages daily, no response. Finally, on April 11th, I threw my hands up in the air, went down to my local Tax Collector, and forked over close to $500 - this cured my "friend"'s suspended license, took care of an outstanding toll, and renewed the tag for a year. On Saturday, I brought the car in for an oil change, new filters, tire rotation and new wiper blades (another close to $250). Uber and Lyft lifted my suspension and I was back driving again! I sent my "friend" all the receipts and told him that I was now out almost $750 taking care of things that he should have been on top of - nay, PROMISED me he would be on top of!

THE FINAL STRAW... and why I need YOUR help!

The following Monday afternoon, I'm sitting in my office working on a project for a client (I have a graphic design business, which like almost everything else in this economy has suffered somewhat over the last year). My roommate walks in the door and seems surprised to see me. She says "Oh, your home! I didn't see your car so I thought you were out driving this afternoon."

I ran to the front window, and sure enough... THE CAR IS GONE! I check my security system, and it was towed away so quickly and quietly not an hour previously that my dogs didn't even wake up from their afternoon nap. That's right, after what amounts to thousands of dollars spent maintaining the car and paying for various fines, fees, etc... my "friend" - who previously told me he owned the car free and clear, having bought it when the lease was up - actually had an auto loan that he had defaulted on. The car was repossessed - either one of the roving license plate reading teams scanned it while it was sitting in my front yard, or my "friend" told them where I lived. Either way, not only am I car-less, but due to prolonged periods of time when I could not drive for Uber/Lyft coupled with the almost $500 I spent taking care of his legal obligations just so I would be able to renew the registration... I can't even afford a down payment.

Adding to the urgency, back in November my girlfriend and I came to the conclusion that we didn't work as romantic partners. Although we remain good friends and are currently living in the same house, she will be selling the house later this year, and I need a vehicle well before that happens (so I can earn additional "moving money" by driving Uber/Lyft,

HERE'S WHERE YOU COME IN!

I'm humbly asking for your help by chipping in whatever you feel comfortable with so I can hit my goal of having $5,000 for a down payment on a 2015 or newer SUV. This would enable me to finance the remaining $5,000-$7,500 with a payment under $250. Of course, it would be wonderful if you all were so generous that I was able to purchase a vehicle outright with your donations, but I also need to rebuild my credit (I've taken n absolute beating credit-wise the last 18 months or so, and I'm working on pulling my score out of the gutter).

I used to be one of those people who was constantly borrowing money from people, but the last 15 years or so I've been able to be relatively self-sufficient. Telling you my story - and essentially BEGGING for your help - is extremely difficult for me, as I never thought I'd be in this sort of a position ever again.

Thanks in advance for your generosity.