Donation protected

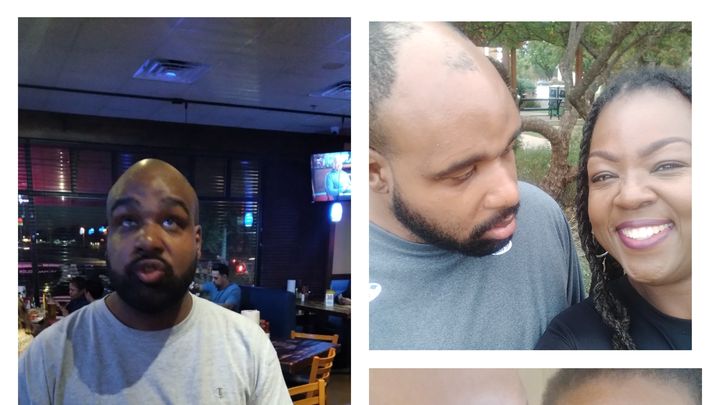

Hi! My name is Ramona and I am fundraising for caregiving costs and related expenses. This year I celebrate 30 years as an elementary school educator and 37 years as the single Mom of my younger son who is autistic and nonverbal. The pandemic created new challenges and dilemmas for my already struggling household. After 29 years of dedicated service to my employer, I was forced to resign due to a reduction in my salary related to the caregiving of my son. Marlon's previous day habilitation program shut down due to COVID. While I was teaching from home, I was simultaneously caring for my son and supervising his speech, occupational, and behavioral therapy sessions. When I was required to return to "in-person" classroom instruction, I was forced to find a new placement for Marlon. Fortunately, I was able to identify a quality program for him. However, the hours did not complement my required reporting time for work. Therefore, I had to request a one-hour delayed report time. As a result, my already meager salary was reduced by $10,000. I tried my best to work through it but eventually resigned in February 2022. I did some substitute teaching and withdrew money from my skimpy 403B plan to make ends meet while I searched for more gainful employment. In March, I accepted a 5th-grade position in a public school. I started at my new school in August. It has been a breath of fresh air! I am learning so much. I adore the kids and my new colleagues are super supportive. My salary is a few thousand dollars more than what my salary was prior to being "docked." Nevertheless, the debt incurred as a result of the hit to my income has snowballed into credit card debt, deferred car repairs, and a perpetual state of "robbing Peter to pay Paul." Although I am a skilled budgeter, I simply cannot make the ends meet. In addition to the typical monthly expenses of rent, car insurance, gas, utility bills, groceries, etc; I also have the additional expenses of $600 caregiver/nanny costs and about $300 after-school care. I pay a woman to sit with Marlon from 6:30 am until about 8 am. She then drives him to school. Because the state only funds 8:30 - 2:30 of Marlon's school day; I must pay for the extended day starting at 2:30. Fortunately, I have no car payment. However, I do have approximately $8,000 in total debt from credit cards and payday loans. My desire is to restore the credit I had improved in 2019 as well as return to saving. This is important to me because as my son's sole caregiver it is vital that I position myself for financial stability. Now that I am teaching in a setting with better benefits and a solid retirement plan, I can likely achieve the dream of retirement at 62 years of age. Any funds raised will first go to paying Marlon's extended day fees to his dayhab program through May to cover my work days until the end of the school year. I will also pay off the payday loans and credit cards and close the accounts. This will allow me the room I need to breathe and give me the initiative to work a summer job in order to prepay for extended daycare for the 2023 - 2024 school year. I am currently researching "work from home" part-time positions to supplement my income for the upcoming school year. I am POSITIVE that God will make a way as He has always done. I have been blessed to be visited by angels in the past. I TRUST that God will send angels here as well. "For I know the plans I have for you," declares the Lord. "Plans to prosper and not to harm you - plans to give you hope and a future." Jeremiah 29:11

Grace and Peace,

Ramona

Organizer

Ramona Thomas

Organizer

Wylie, TX