Cashier Check Scam Repayment

The second week of May 2018, my husband and I listed our Chevrolet Camaro to be sold on Cars.com. A buyer reached out to my husband via [phone redacted] named Lawrence Baker on 5/15/18 saying he was interested in the car. He said he lived in CA but owned a garage on the east coast where he would take the car. He told us he would be sending us a check made out to my name. A cashier's check was sent from the buyer named Lawrence Baker with address 4 Adams St, Morganville NJ 07751-1002 on the outside of the Priority Mail envelope. The check was from Citibank and had a bank signature on it. Lawrence told my husband that he would be sending us more than we asked for so that we could arrange the transporter of his garage that he owned in Maryland. He sent a check of $23,770 for the price of the vehicle ($19K) and so that we should deposit another check ($4770.00) once that cleared into the transporter's account at any Wells Fargo. He asked for images of the Wells Fargo check and the deposit receipt. The name on the account at Wells Fargo was “Fonka Robert” account number 3911085136. My husband did talk to Lawrence on 5/21/2018 and so we did not expect fraud.

The original cashier’s check of $23,770 was deposited at Bank of America in Tucson, AZ on 5/21/2018 and funds were made available 5/22/2018, and so on Tuesday 5/22/2018, I made out two cashier's checks, one for our lien holder to pay off the car and deposited the transporter check in the Wells Fargo account without knowledge of fraud. We were not provided with information regarding the name of the transport company. The check for Ally Bank was sent to the Payment Processing Center. It arrived at Ally Bank on 5/23/2018.

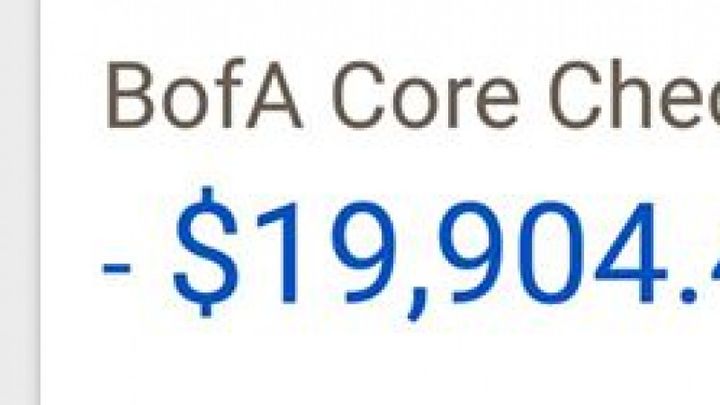

Suddenly something was wrong. The check of $23,770 was then put on hold on 5/23/18, over-drafting my account by $19,904.41 (I had over $3500 in my account before this issue). Bank of America had sent me a notice saying my balance fell before $25. I called Bank of America, and they said that the cashier check of $23770 was held due to an issue with the funds in the account of the bank that issued the mailed cashier's check; they advised contacting that bank with the check number. I called Citibank (the check for $23,770 was made out from) and they said it is possible that this was a fraudulent transaction but could not provide me information on the account. I then called Ally Bank, but they had received the cashier check already. I could not cancel either cashier’s checks that I made out to Ally Bank or the Wells Fargo account. We attempted contact with the buyer who told us he would get "everything straightened out" on his end. He then said he would contact us and has since not. We told him that if he did not respond to us, we would be pursing legal action. We never did hear back, and that was when we learned that cashier check scams are VERY REAL and VERY damaging.

Upon further investigation, the address listed on the label of the priority mail envelope was apparently a property that is listed for sale in New Jersey, and the buyer's address that he gave us was in Moreno Valley CA does not exist. At this point we determined we were victims of a scam. We followed up with Ally Bank and Bank of America as well as Wells Fargo and Citibank and filed complaints with the USPIS, FTC, and the Arizona State Attorney General. We were also instructed to file a police report with local authorities.

According to federal law, banks generally must make funds available to you from most governmental checks and official bank checks including cashier checks. However, just because you have access to the funds does not mean the check is good. Forgeries or account fraud can take weeks to find out. If it was not for this federal loophole in access to funds, this scam would not be possible. We are smart people, but we were still duped. This is a very popular scam which uses third parties to move money around. What they really got from us is $4770, but the full $23770 is gone from my account.

Because I withdrew the funds when they were available, I am 100% responsible for my overdrawn account despite being the victim of a scam. It is a terrible feeling to feel that you are helpless in a situation that is out of your control.

I luckily had one paycheck go into my account so my account is only overdrawn by about $19,300. I hope to bring this issue to light for anyone who may encounter a similar issue.

For more information on cashier check scams, I have linked below information from the FTC on them:

https://www.consumer.ftc.gov/articles/0159-fake-checks

If you feel you are the victim of fraud, please contact your bank, relevant institutions that also may be involved, and also contact the FTC, the US Postal Inspection Service, and your State Attorney General. File a police report with your local authorities, and even call your insurance to see if you are eligible.

FTC - https://www.ftccomplaintassistant.gov/

USPIS - https://postalinspectors.uspis.gov/

State Attorney General (how to find yours) - http://www.naag.org/

Thank you for reading <3

With love,

Kate Alucard

The original cashier’s check of $23,770 was deposited at Bank of America in Tucson, AZ on 5/21/2018 and funds were made available 5/22/2018, and so on Tuesday 5/22/2018, I made out two cashier's checks, one for our lien holder to pay off the car and deposited the transporter check in the Wells Fargo account without knowledge of fraud. We were not provided with information regarding the name of the transport company. The check for Ally Bank was sent to the Payment Processing Center. It arrived at Ally Bank on 5/23/2018.

Suddenly something was wrong. The check of $23,770 was then put on hold on 5/23/18, over-drafting my account by $19,904.41 (I had over $3500 in my account before this issue). Bank of America had sent me a notice saying my balance fell before $25. I called Bank of America, and they said that the cashier check of $23770 was held due to an issue with the funds in the account of the bank that issued the mailed cashier's check; they advised contacting that bank with the check number. I called Citibank (the check for $23,770 was made out from) and they said it is possible that this was a fraudulent transaction but could not provide me information on the account. I then called Ally Bank, but they had received the cashier check already. I could not cancel either cashier’s checks that I made out to Ally Bank or the Wells Fargo account. We attempted contact with the buyer who told us he would get "everything straightened out" on his end. He then said he would contact us and has since not. We told him that if he did not respond to us, we would be pursing legal action. We never did hear back, and that was when we learned that cashier check scams are VERY REAL and VERY damaging.

Upon further investigation, the address listed on the label of the priority mail envelope was apparently a property that is listed for sale in New Jersey, and the buyer's address that he gave us was in Moreno Valley CA does not exist. At this point we determined we were victims of a scam. We followed up with Ally Bank and Bank of America as well as Wells Fargo and Citibank and filed complaints with the USPIS, FTC, and the Arizona State Attorney General. We were also instructed to file a police report with local authorities.

According to federal law, banks generally must make funds available to you from most governmental checks and official bank checks including cashier checks. However, just because you have access to the funds does not mean the check is good. Forgeries or account fraud can take weeks to find out. If it was not for this federal loophole in access to funds, this scam would not be possible. We are smart people, but we were still duped. This is a very popular scam which uses third parties to move money around. What they really got from us is $4770, but the full $23770 is gone from my account.

Because I withdrew the funds when they were available, I am 100% responsible for my overdrawn account despite being the victim of a scam. It is a terrible feeling to feel that you are helpless in a situation that is out of your control.

I luckily had one paycheck go into my account so my account is only overdrawn by about $19,300. I hope to bring this issue to light for anyone who may encounter a similar issue.

For more information on cashier check scams, I have linked below information from the FTC on them:

https://www.consumer.ftc.gov/articles/0159-fake-checks

If you feel you are the victim of fraud, please contact your bank, relevant institutions that also may be involved, and also contact the FTC, the US Postal Inspection Service, and your State Attorney General. File a police report with your local authorities, and even call your insurance to see if you are eligible.

FTC - https://www.ftccomplaintassistant.gov/

USPIS - https://postalinspectors.uspis.gov/

State Attorney General (how to find yours) - http://www.naag.org/

Thank you for reading <3

With love,

Kate Alucard

Organizer

Kate Alucard

Organizer

Tucson, AZ