THE NHS IS GOING TO STEAL MY PENSION

Donation protected

I have worked as a GP Surgery Manager for 27 years. I’m a profit sharing partner and I love my job. It’s hard work, often for 45 hours a week or more. When I reached my 61st birthday I decided to take my NHS Pension, but also to continue to work.

As a profit-sharing partner I am self-employed, which means that I was paying both the employer and employee pension contributions into the NHS Pension.

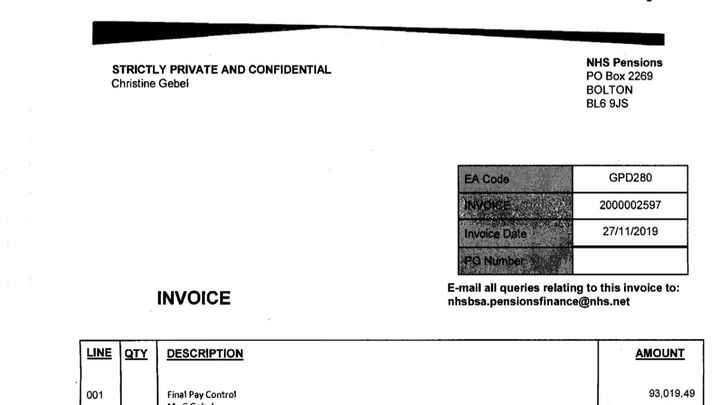

Imagine my horror when, just before Christmas this year, I received notification of a Final Pay Controls “fine” of £93,019.49.

Final Pay Controls charges were introduced in 2014 to prevent GP Practices artificially inflating earnings in order to boost pensions. FPC only applies to workers in the 1995 Section of the NHS Pension Scheme who retire with entitlement to officer benefits. If a member receives an increase in pensionable pay that exceeds the allowable amount (determined by increasing the member’s pensionable pay in the year immediately preceding the relevant year by CPI plus 4.5%), the employing authority that awarded the “excess” pay will be liable for a Final Pay Controls charge. Since I am a profit-sharing partner, the charge is payable by me personally.

I didn’t actually breach the FPC limits; my share of Practice profits dropped rather than increased in the last year. Unfortunately, Primary Care Support England who “manage” (joke) GP Practice pensions put the wrong figures on my retirement application form.

I’ve been told that there is no provision under the regulations to apply any discretion in respect of the actual charge and I am unable to appeal against it. Everyone I have contacted agrees that it’s an outrageous and unjust charge and that Final Pay Controls were never put in place to penalise people like me.

A daily interest charge is being applied, plus a £75.00 administration charge. However in “good faith” those lovely people at NHSBSA are offering a repayment plan! They haven’t said if the plan can extend for 70 years, but that’s how long I’ll need to pay off the charge if I use every penny of my monthly pension.

I wonder how many GP Practices in England are aware that they could be sitting on a Final Pay Controls charge time-bomb? The charges don’t just apply to profit sharing partners and the FPC limits are not set very high - if a Practice has staff in the 1995 Scheme and has been foolish enough to reward their hard work with a decent pay increase in the last 3 years of their working life, then they could be in for a very nasty surprise. Any Practice planning to upskill their workforce to meet the challenges of the new Primary Care Network had better make sure this does not land them with an enormous FPC charge.

You are welcome to comment without donating. In the highly unlikely event that I raise more than £93,019.49, or that the FPC charge is cancelled, I will donate the monies received to the Air Ambulance Service.

Thank you for reading this.

Chris Gebel

As a profit-sharing partner I am self-employed, which means that I was paying both the employer and employee pension contributions into the NHS Pension.

Imagine my horror when, just before Christmas this year, I received notification of a Final Pay Controls “fine” of £93,019.49.

Final Pay Controls charges were introduced in 2014 to prevent GP Practices artificially inflating earnings in order to boost pensions. FPC only applies to workers in the 1995 Section of the NHS Pension Scheme who retire with entitlement to officer benefits. If a member receives an increase in pensionable pay that exceeds the allowable amount (determined by increasing the member’s pensionable pay in the year immediately preceding the relevant year by CPI plus 4.5%), the employing authority that awarded the “excess” pay will be liable for a Final Pay Controls charge. Since I am a profit-sharing partner, the charge is payable by me personally.

I didn’t actually breach the FPC limits; my share of Practice profits dropped rather than increased in the last year. Unfortunately, Primary Care Support England who “manage” (joke) GP Practice pensions put the wrong figures on my retirement application form.

I’ve been told that there is no provision under the regulations to apply any discretion in respect of the actual charge and I am unable to appeal against it. Everyone I have contacted agrees that it’s an outrageous and unjust charge and that Final Pay Controls were never put in place to penalise people like me.

A daily interest charge is being applied, plus a £75.00 administration charge. However in “good faith” those lovely people at NHSBSA are offering a repayment plan! They haven’t said if the plan can extend for 70 years, but that’s how long I’ll need to pay off the charge if I use every penny of my monthly pension.

I wonder how many GP Practices in England are aware that they could be sitting on a Final Pay Controls charge time-bomb? The charges don’t just apply to profit sharing partners and the FPC limits are not set very high - if a Practice has staff in the 1995 Scheme and has been foolish enough to reward their hard work with a decent pay increase in the last 3 years of their working life, then they could be in for a very nasty surprise. Any Practice planning to upskill their workforce to meet the challenges of the new Primary Care Network had better make sure this does not land them with an enormous FPC charge.

You are welcome to comment without donating. In the highly unlikely event that I raise more than £93,019.49, or that the FPC charge is cancelled, I will donate the monies received to the Air Ambulance Service.

Thank you for reading this.

Chris Gebel

Organizer

Chris Gebel

Organizer