Arthur St. John

Donation protected

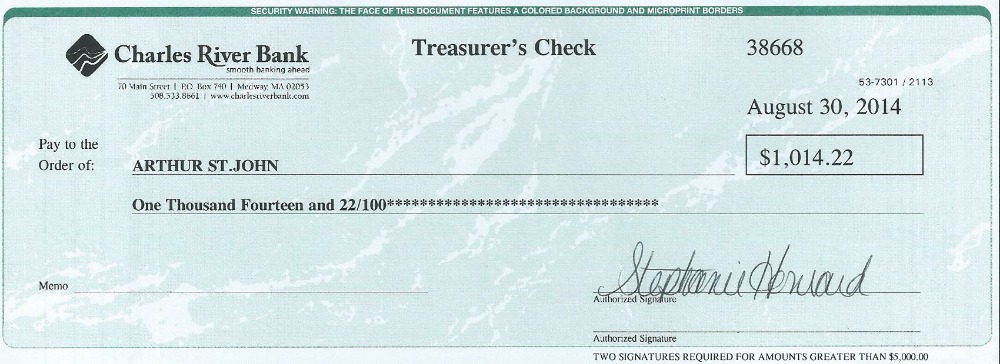

Another check for Arthur !!

94 Year old Market Basket bagger Arthur St. John is one of the hundreds of part-time employees who has been asked not to report to work next week.

He is hoping that today's news is only a temporary setback for him.

"I've got to keep going, I'll keep going somehow," he said,

You can read about Arthur tomorrow in the Exeter News-Letter

Arthur needs our support through this difficult time.

Organizer

Bonnie Milano

Organizer

Medway, MA