Cam vs. J.P. Morgan Chase Bank - fraud

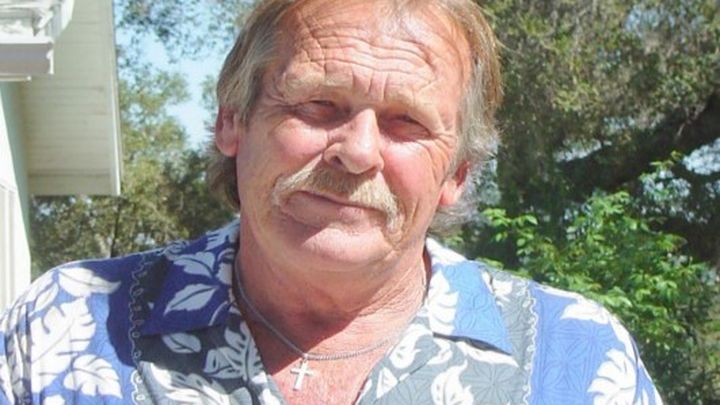

My name is Campbell (Cam) Carroll and I need prayers and financial support.

Due to the mortgage fraud that has been perpetuated upon the American public, I am entrenched in a legal battle to save my own home and to hopefully set a precedent that will pave the way for many others to do the same.

My case is filed with the Superior Court of California, County of San Luis Obispo, CV No. 128281

See portions of case file here at CalCoastNews.com:

http://calcoastnews.com/2012/10/follow-the-rules-forfeit-your-home/

Many of you may not be aware of this, but if you have financed your property in any fashion during the last decade, your loan - like mine - has probably been securitized. What this means is that your note is currently, permanently and illegally separated from your deed of trust. In short, you're probably remitting mortgage payments to an institution that has no legal grounds to collect those funds; hence, that institution cannot reconvey your clear deed of trust back to you even after you have fully satisfied the terms of your now securitized note.

My nightmare started when, like many other California homeowners, I found myself out of work and collecting unemployment benefits. At that time, I attempted to take advantage of the mortgage modifications that J.P. Morgan Chase Bank was advertising to assist American homeowners with affordable low interest mortgage loans.

Like many others, I applied in good faith for one of those modifications. My mortgagee, Chase Home Finance, LLC provided a uniform loan document package which I completed and submitted over and over again as they continually claimed to be missing a document or required more information. Over a period of six months, my local bank manager assisted me with the harrowing task of providing the never ending stream of demands. During this lengthy process, Chase Home Finance told me that I could begin remitting ½ monthly mortgage payments which I did faithfully; in fact I had never missed a mortgage payment and was a customer in good standing until I applied for a modification and began following their instructions!

After more than 9 months of working with CHF, I received a FINAL DENIAL for my loan modification. Initially the denial was for failing to submit my documents in a timely fashion; however that denial was rescinded after my bank manager personally contacted Chase Bank informing them that she had submitted the documents in question herself, and she had retained time stamped copies. As a result, Chase Bank instructed me to ignore the denial letter. A week later, I received a FINAL DENIAL letter informing me that I didn't qualify because I was collecting unemployment benefits. I was collecting unemployment benefits when I began this process and had disclosed this fact in countless documents right from the start. Attached to my denial was a demand to immediately remit all past outstanding balances, late fees and interest on amortized interest or face foreclosure. During this process, they also reported me to the credit agencies as delinquent, thus damaging my credit score beyond repair. Unable to remit the funds they were now demanding, I was told to offer my property up for a "short sale" or face foreclosure.

I decided right then and there to fight J.P. Morgan Chase Bank for my rights and my home, and I thank the good Lord that thus far, I have been able to follow through with that conviction. My attorney here in San Luis Obispo County learned that not only did J.P. Morgan Chase Bank and their affiliates commit fraud upon me and many other homeowners, but they have no standing to collect mortgage payments from me as they don't possess my note; in fact, it has been fraudulently securitized without my consent.

It would appear that Chase Bank and others aren't interested in using the bail out funds provided by our Federal tax dollars to assist honest hard working American citizens with a loan modification or refinance. Instead, it appears that their only interest is in selling our homes out from under us before we find out that our chain of title has been forever clouded by fraudulent unrecorded assignments, and it cannot be ascertained who - if anyone "“ is the "holder in due course" legally entitled to receive payment and reconvey legal title upon pay off. Read about the facts behind securitization as set forth in my lawsuit by clicking the above link. My case file is attached to the story at that media site.

Currently, a local judge signed a restraining order on September 20, 2012, just moments before my home was illegally going to be auctioned to the highest bidder on the front steps of the San Luis Obispo Superior Court. I believe that I can win this battle, save my home, expose the fraud being perpetrated upon the public and possibly set a precedent for California or even the rest of America. I have financed my lawsuit thus far but am still unemployed. I desperately need additional funding to finish this legal battle and to expose J.P. Morgan Chase Bank, "the bank that is too big to fail", in a court of law. Whether or not you're able to send a donation towards this cause, please say a prayer for me as I fight this fight.

Do you believe the story of David and Goliath? I do.

Sincerely,

Cam Carroll