Enforcing Consumer Laws

I am currently suing debt buyer Midland Funding (subsidiary of Encore Financial Group) and the credit bureaus for violations of the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA) and more info is posted at http://creditsuit.org/

Your support is needed to:

*** Properly pursue Midland Funding and the credit bureaus in court for their false credit reporting.

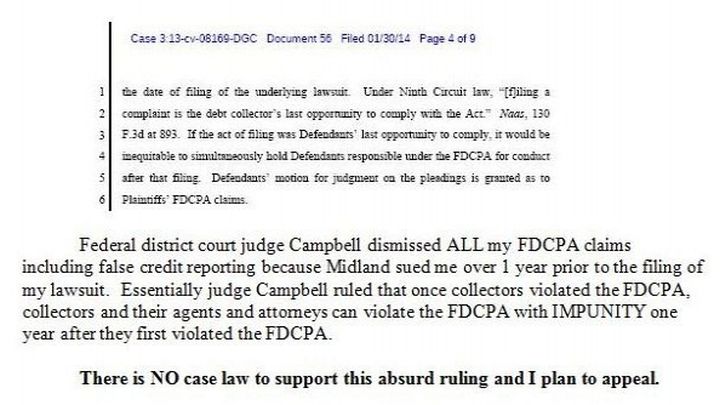

*** Appeal the absurd ruling dismissing all FDCPA claims.

*** Establish a consumer litigation resource forum.

*** Contact all Arizona NACA attorneys to determine what needs to change so that EVERY consumer with a valid claim has access to legal representation.

*** Prepare a report outlining the problems consumers face when seeking justice in our courts and presenting solutions.

*** Create a listing of proposed changes to the FCRA and FDCPA, including much higher minimum statutory damages.

*** Contact regulators and legislators (see my previous submissions)

*** Establish a FEDERAL CONSUMER COURT with judges trained in consumer protection laws, with all proceedings online, plain English (no legalese) and simplified discovery rules.

I realize that it won't be easy to establish a new consumer court. Creating the Consumer Financial Protection Bureau (CFPB) was a step in the right direction, but unfortunately, it is not nearly powerful enough to cause credit bureaus and collectors to comply with the law voluntarily.

While consumers can submit their complaints to the CFPB, it does absolutely NOTHING to assist the consumers!

I filed my complaint about Equifax's refusal to provide me with my free annual credit report with the CFPB.

Subsequently, Equifax did NOT provide me with the free report and it lied to the CFPB. The CFPB did NOTHING.

The system is designed to make it easy for scummy corporations to defraud consumers.

After all, it's much easier and cheaper to just BUY a credit report than to file complaints and go through all this aggravation for NOTHING.

This CORRUPT system must be CHANGED.

I have created positive change in the past through my many publications. I love to help people and on a slow day I'll compile links to some of my fraud documentaries.

I've spent decades on fighting for others, drafting their complaints to regulators and publishing their causes at NO CHARGE whatsoever. That's why I had no saving when the economy collapsed and my income vanished.

If consumers don't support my work, I really don't need to waste my time on these projects. So this is my "poll" and you can vote with your money and possibly time.

Please support my projects if you care!

Background

In 2006 I started to build my home in the high desert in NW Arizona with credit cards while getting my old home ready for sale. It finally sold for much less than expected and the pre-approvals for a mortgage on my new home were no longer honored by the banks. Additionally, the economic meltdown left my FICO score consulting business in shambles as few people were looking to buy homes. I had no choice but to stop paying my credit cards.

Many creditors and debt buyers sued me. While no creditor received a judgment against me, I wasted YEARS in court defending myself. I prevailed against debt buyer Acarta in the Arizona court of appeals. I published the Acarta court filings so that other consumers can use them in their own battles against lawless debt collectors.

The claim of notorious debt buyer Midland Funding (subsidiary of Encore Capital Group) was time barred -- the statue of limitations had expired months before it filed suit. I started to post about this lawsuit at http://creditsuit.org/

Twice I had requested assistence from every Arizona NACA attorney, but nobody offered to represent me.

Once again I was pro se and while the Kingman justice court granted my motion for summary judgment, I didn't get a penny for my costs and time defending myself.

So I sued Midland Funding and its servicer Midland Credit Management in June 2013. After over a year in court and a very bizarre ruling, granting debt collectors, their agents and attorneys immunity for any and all violations of the Fair Debt Collection Practices Act (FDCPA) committed over one year after filing suit for a time barred debt, Midland is still reporting INCORRECT information to the credit bureaus.

I recently added credit bureau Equifax and I am about to file a motion to add Trans Union, as both credit bureaus verified the incorrect information.

Throughout the litigation the Midland attorneys made completely false statements to me and to the court and occasionally they simply ignore my emails.

We need a CONSUMER COURT with judges well trained in consumer law and ensuring that FAIR and SPEEDY proceedings will result in JUSTICE.

Regulators & legislators need to be made aware of the shortfalls of our judicial system.

The many MILLIONS of consumers whose credit is ruined by incorrect information and who are abused by vile debt buyers and debt collectors need to be able to not only stop illegal activities, but to get adequate COMPENSATION for their damages.

It infuriates me that the Midland attorneys claim that I am NOT entitled to damages caused by the litigation because I'm not an attorney and only attorneys can get awards for attorneys fees.

The Midland attorneys stated that I caused the litigation related damages by filing the lawsuit. That's very much like the argument that a people who were raped caused their damages by trying to fight off the rapists.

I am determined to fight Midland and their lying lawyers and post all correspondence and court filings, but my day has only 24 hours and I can't afford to pay for legal resources such as WestLaw and don't have the funds to travel to California and pay for depositions.

I'll update http://creditsuit.org/ and in the Litigation Forum.